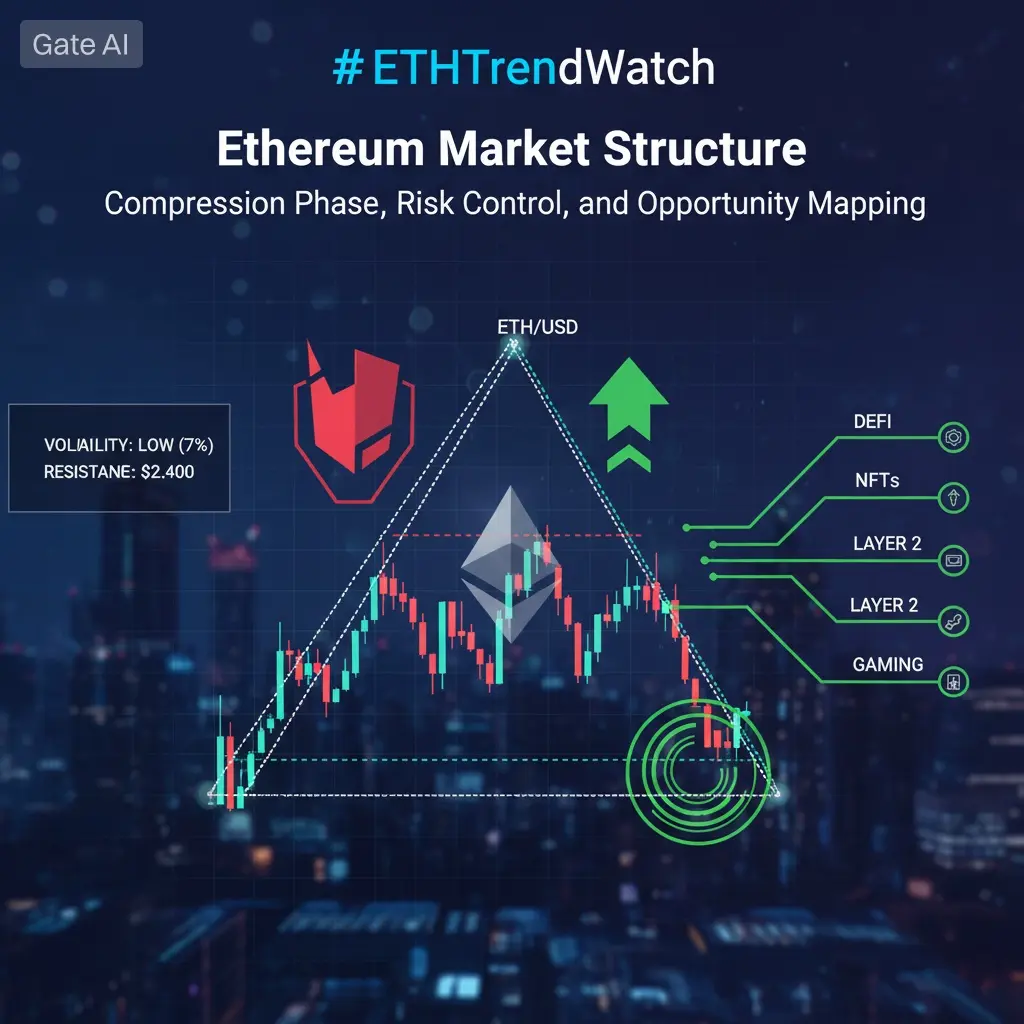

#ETHTrendWatch

Ethereum Market Structure: Compression Phase, Risk Control, and Opportunity Mapping

Ethereum (ETH) is currently trading in a compressed price environment where volatility exists, but directional conviction remains limited. Price has been rotating within a clearly defined band, reflecting a market that is active — yet deliberately cautious. This behavior suggests positioning rather than trend expansion.

Over recent weeks, ETH has respected a broader range roughly spanning the low $3,000 area up toward the mid-$3,000s. Buyers have shown willingness to step in on pullbacks, while sellers continue to defend higher levels. The result is a market defined by balance, not momentum.

Technical Structure in Focus

Support interest has repeatedly emerged near psychologically and technically relevant zones, where short-term averages and historical reactions converge. These areas continue to attract responsive buying, indicating that downside pressure lacks follow-through.

On the upside, rallies have struggled to maintain traction beyond upper resistance bands, where liquidity consistently thins and profit realization increases. This ceiling has capped advances and prevented sustained trend continuation, reinforcing the current range-bound regime.

Importantly, Ethereum remains positioned above its long-term structural trend benchmarks, including the 200-week moving average. This placement preserves the broader bullish framework, even as shorter-timeframe price action remains indecisive.

Volume and Participation Dynamics

Volume behavior aligns with a controlled consolidation narrative. Activity expands near support zones, signaling accumulation, while advances toward resistance encounter distribution rather than breakout acceleration. This pattern typically precedes a larger directional move — but timing remains unresolved.

There are no signs of panic or speculative excess. Instead, participation appears measured, suggesting professional positioning rather than emotional flow.

Macro and Cross-Market Influence

Ethereum’s price action continues to be closely linked to Bitcoin’s directional bias and global liquidity expectations. In periods of improving risk appetite, ETH historically exhibits relative strength. Conversely, tightening conditions favor compression and sideways discovery — a dynamic currently in play.

As long as macro signals remain mixed, Ethereum is likely to remain reactive rather than impulsive.

Strategy by Market Horizon

Short-term participants are watching for confirmation beyond upper resistance zones, seeking momentum alignment through tools like RSI, MACD, and volume expansion. A confirmed breakout would shift focus toward higher continuation targets.

Range-focused traders continue to operate within defined boundaries, emphasizing precision entries, reduced leverage, and disciplined exits.

Long-term holders may view this phase as constructive consolidation. Ethereum’s role across DeFi infrastructure, Layer-2 ecosystems, staking economics, and on-chain utility supports a gradual accumulation thesis rather than aggressive timing.

Risk Considerations

Failure to hold key support levels would alter the current structure and expose ETH to deeper corrective phases. Capital preservation remains critical — position sizing, stop placement, and macro awareness should guide execution at all times.

Closing Perspective

Ethereum is not trending — but it is not weak. The market is compressing, storing potential energy while awaiting confirmation from liquidity conditions, Bitcoin direction, and technical resolution. Until those elements align, success depends less on prediction and more on structure-based decision making.

Traders and investors who respect the range, manage risk, and stay aligned with macro signals will be best positioned for Ethereum’s next decisive phase — whether it resolves upward through expansion or downward into a higher-quality accumulation zone.

Ethereum Market Structure: Compression Phase, Risk Control, and Opportunity Mapping

Ethereum (ETH) is currently trading in a compressed price environment where volatility exists, but directional conviction remains limited. Price has been rotating within a clearly defined band, reflecting a market that is active — yet deliberately cautious. This behavior suggests positioning rather than trend expansion.

Over recent weeks, ETH has respected a broader range roughly spanning the low $3,000 area up toward the mid-$3,000s. Buyers have shown willingness to step in on pullbacks, while sellers continue to defend higher levels. The result is a market defined by balance, not momentum.

Technical Structure in Focus

Support interest has repeatedly emerged near psychologically and technically relevant zones, where short-term averages and historical reactions converge. These areas continue to attract responsive buying, indicating that downside pressure lacks follow-through.

On the upside, rallies have struggled to maintain traction beyond upper resistance bands, where liquidity consistently thins and profit realization increases. This ceiling has capped advances and prevented sustained trend continuation, reinforcing the current range-bound regime.

Importantly, Ethereum remains positioned above its long-term structural trend benchmarks, including the 200-week moving average. This placement preserves the broader bullish framework, even as shorter-timeframe price action remains indecisive.

Volume and Participation Dynamics

Volume behavior aligns with a controlled consolidation narrative. Activity expands near support zones, signaling accumulation, while advances toward resistance encounter distribution rather than breakout acceleration. This pattern typically precedes a larger directional move — but timing remains unresolved.

There are no signs of panic or speculative excess. Instead, participation appears measured, suggesting professional positioning rather than emotional flow.

Macro and Cross-Market Influence

Ethereum’s price action continues to be closely linked to Bitcoin’s directional bias and global liquidity expectations. In periods of improving risk appetite, ETH historically exhibits relative strength. Conversely, tightening conditions favor compression and sideways discovery — a dynamic currently in play.

As long as macro signals remain mixed, Ethereum is likely to remain reactive rather than impulsive.

Strategy by Market Horizon

Short-term participants are watching for confirmation beyond upper resistance zones, seeking momentum alignment through tools like RSI, MACD, and volume expansion. A confirmed breakout would shift focus toward higher continuation targets.

Range-focused traders continue to operate within defined boundaries, emphasizing precision entries, reduced leverage, and disciplined exits.

Long-term holders may view this phase as constructive consolidation. Ethereum’s role across DeFi infrastructure, Layer-2 ecosystems, staking economics, and on-chain utility supports a gradual accumulation thesis rather than aggressive timing.

Risk Considerations

Failure to hold key support levels would alter the current structure and expose ETH to deeper corrective phases. Capital preservation remains critical — position sizing, stop placement, and macro awareness should guide execution at all times.

Closing Perspective

Ethereum is not trending — but it is not weak. The market is compressing, storing potential energy while awaiting confirmation from liquidity conditions, Bitcoin direction, and technical resolution. Until those elements align, success depends less on prediction and more on structure-based decision making.

Traders and investors who respect the range, manage risk, and stay aligned with macro signals will be best positioned for Ethereum’s next decisive phase — whether it resolves upward through expansion or downward into a higher-quality accumulation zone.