KyleChassé

No content yet

KyleChassé

🚨 WALL STREET JUST WENT DEEPER INTO BITCOIN

Citigroup with $2.4T in assets is rolling out institutional Bitcoin custody, wallets, and key management.

Morgan Stanley with nearly $9T is launching a proprietary Bitcoin platform, with spot trading potentially coming to E*Trade and lending products under review.

Now add this.

Barclays is exploring blockchain rails for payments, stablecoins, and tokenized deposits, following moves by JPMorgan Chase.

This is the core of the global banking system integrating Bitcoin and blockchain infrastructure because clients are demanding it and ETFs proved the ap

Citigroup with $2.4T in assets is rolling out institutional Bitcoin custody, wallets, and key management.

Morgan Stanley with nearly $9T is launching a proprietary Bitcoin platform, with spot trading potentially coming to E*Trade and lending products under review.

Now add this.

Barclays is exploring blockchain rails for payments, stablecoins, and tokenized deposits, following moves by JPMorgan Chase.

This is the core of the global banking system integrating Bitcoin and blockchain infrastructure because clients are demanding it and ETFs proved the ap

BTC-2,47%

- Reward

- like

- Comment

- Repost

- Share

🚨 AMAZON AND OPENAI JUST LOCKED IN THE AI STACK

Amazon is investing $50B into OpenAI.

AWS becomes the exclusive third party cloud for OpenAI Frontier.

OpenAI locks in massive Trainium compute.

They are building stateful AI agents that remember context, access tools, and run inside real enterprise workflows.

This is distribution plus compute aligning at global scale.

The infrastructure layer of the AI economy is being cemented.

Amazon is investing $50B into OpenAI.

AWS becomes the exclusive third party cloud for OpenAI Frontier.

OpenAI locks in massive Trainium compute.

They are building stateful AI agents that remember context, access tools, and run inside real enterprise workflows.

This is distribution plus compute aligning at global scale.

The infrastructure layer of the AI economy is being cemented.

- Reward

- like

- 2

- Repost

- Share

Lions_Lionish :

:

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵View More

🚨 WHALES ARE BUYING THE DIP

Data from Santiment shows 19,993 wallets now hold at least 100 BTC.

That is nearly 20,000 whale addresses.

This happened during a price dip around 67,800.

Translation.

Large holders are absorbing supply while retail hesitates.

Each of those wallets controls roughly 6.7 million dollars worth of Bitcoin.

Ownership is quietly rotating from weak hands to patient capital.

Important nuance.

Whale share of total supply is not spiking. It is steady.

That tempers short term upside.

But historically, these accumulation phases tend to resolve higher once selling pressure drie

Data from Santiment shows 19,993 wallets now hold at least 100 BTC.

That is nearly 20,000 whale addresses.

This happened during a price dip around 67,800.

Translation.

Large holders are absorbing supply while retail hesitates.

Each of those wallets controls roughly 6.7 million dollars worth of Bitcoin.

Ownership is quietly rotating from weak hands to patient capital.

Important nuance.

Whale share of total supply is not spiking. It is steady.

That tempers short term upside.

But historically, these accumulation phases tend to resolve higher once selling pressure drie

BTC-2,47%

- Reward

- 1

- Comment

- Repost

- Share

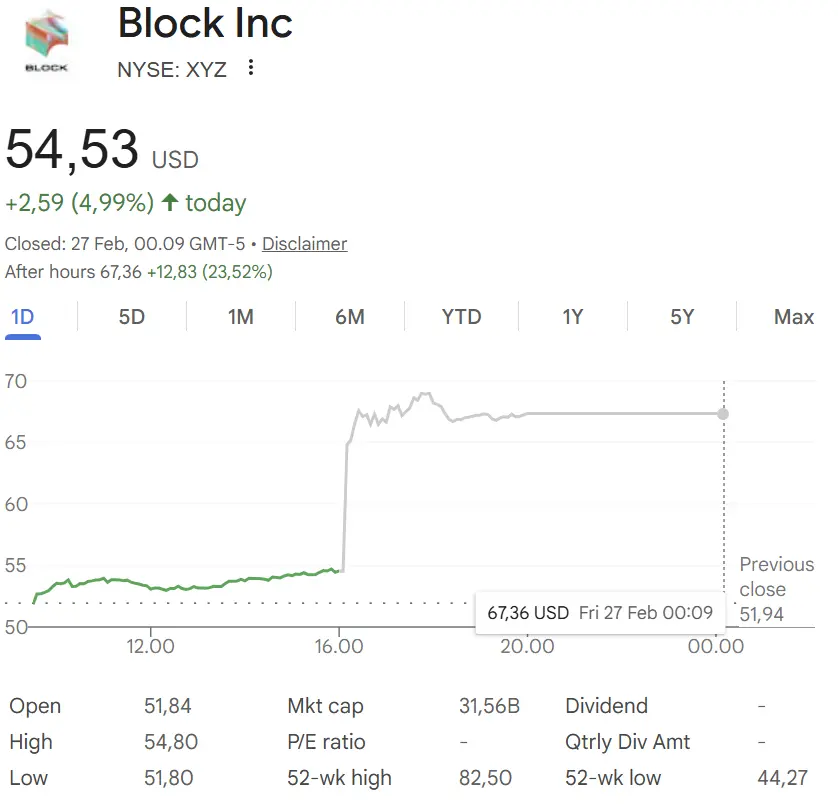

🚨 JACK CUT 4,000 JOBS AND THE STOCK SURGED

Jack Dorsey just reduced Block, Inc. by nearly half.

And immediately after that, the stock SURGED.

Sometimes business requires hard decisions.

And it's unsure whether Dorsey did it just to pump his bag.

What he does next is going to be crucial.

All eyes are on him.

Is that a money grab or the brutal math of public companies?

Jack Dorsey just reduced Block, Inc. by nearly half.

And immediately after that, the stock SURGED.

Sometimes business requires hard decisions.

And it's unsure whether Dorsey did it just to pump his bag.

What he does next is going to be crucial.

All eyes are on him.

Is that a money grab or the brutal math of public companies?

- Reward

- like

- Comment

- Repost

- Share

🚨 JACK CUT 4,000 JOBS

Jack Dorsey just reduced Block, Inc. by nearly half.

The business isn’t collapsing. AI is reshaping how it operates.

This is the painful side of evolution.

Change is hard. Letting people go is harder.

But if companies refuse to adapt when the ground shifts, what are they even building for?

But surely he told them all before making it public?

Jack Dorsey just reduced Block, Inc. by nearly half.

The business isn’t collapsing. AI is reshaping how it operates.

This is the painful side of evolution.

Change is hard. Letting people go is harder.

But if companies refuse to adapt when the ground shifts, what are they even building for?

But surely he told them all before making it public?

- Reward

- like

- Comment

- Repost

- Share

🚨 JACK CUT 4,000 JOBS

Jack Dorsey just reduced Block, Inc. by nearly half.

The business isn’t collapsing.

AI is reshaping how it operates.

This is the painful side of evolution.

Change is hard.

Letting people go is harder.

But if companies refuse to adapt when the ground shifts, what are they even building for?

But surely he told them all before making it public?

Jack Dorsey just reduced Block, Inc. by nearly half.

The business isn’t collapsing.

AI is reshaping how it operates.

This is the painful side of evolution.

Change is hard.

Letting people go is harder.

But if companies refuse to adapt when the ground shifts, what are they even building for?

But surely he told them all before making it public?

- Reward

- like

- Comment

- Repost

- Share

When AI Starts Paying AI

We are not far from a world where major companies are no longer traditional organizations, but coordinated networks of AI agents.

And what do you think payment will be made in?

Instead of hiring thousands of employees, they deploy millions of specialized agents handling legal work, sales, trading, logistics, and security around the clock.

When something needs to get done, they won't post a job listing.

They'll call a network.

“Use our prov

We are not far from a world where major companies are no longer traditional organizations, but coordinated networks of AI agents.

And what do you think payment will be made in?

Instead of hiring thousands of employees, they deploy millions of specialized agents handling legal work, sales, trading, logistics, and security around the clock.

When something needs to get done, they won't post a job listing.

They'll call a network.

“Use our prov

- Reward

- like

- Comment

- Repost

- Share

I have an absolutely WILD video coming out soon.

Everyone is looking at the wrong thing.

This will sort it out.

Everyone is looking at the wrong thing.

This will sort it out.

- Reward

- 2

- Comment

- Repost

- Share

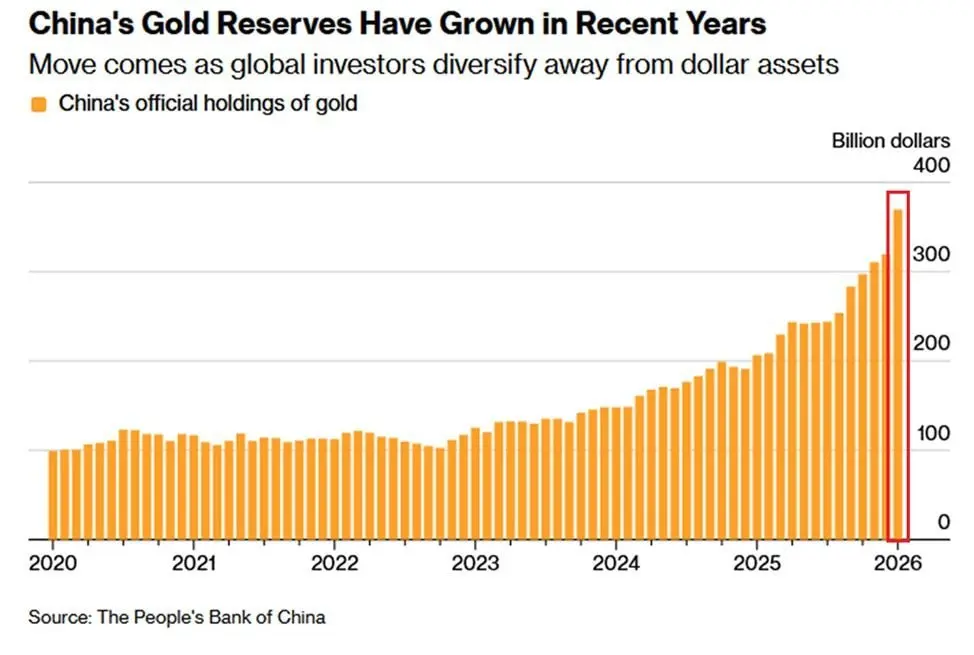

China is stockpiling hard assets at record scale.

The People's Bank of China lifted gold reserves 15.7% MoM in January to $369.6B.

8 straight months of increases.

15 consecutive months of buying.

Since October 2022, reserves are up $266.9B, a 260% surge.

Holdings now sit at a record 2,308 tonnes.

This is not portfolio noise.

It is strategic diversification away from dollar exposure.

When a central bank buys this aggressively, it is signaling long term positioning.

The People's Bank of China lifted gold reserves 15.7% MoM in January to $369.6B.

8 straight months of increases.

15 consecutive months of buying.

Since October 2022, reserves are up $266.9B, a 260% surge.

Holdings now sit at a record 2,308 tonnes.

This is not portfolio noise.

It is strategic diversification away from dollar exposure.

When a central bank buys this aggressively, it is signaling long term positioning.

- Reward

- 1

- Comment

- Repost

- Share

🚨 STATE LEVEL BITCOIN BREAKTHROUGH

Indiana just passed a Bitcoin rights bill through both chambers of the Indiana General Assembly.

Public retirement plans may offer crypto options.

State agencies cannot block lawful crypto use or self custody.

Now it heads to the governor’s desk.

This is how adoption spreads.

Not top down.

State by state.

Indiana just passed a Bitcoin rights bill through both chambers of the Indiana General Assembly.

Public retirement plans may offer crypto options.

State agencies cannot block lawful crypto use or self custody.

Now it heads to the governor’s desk.

This is how adoption spreads.

Not top down.

State by state.

BTC-2,47%

- Reward

- 1

- Comment

- Repost

- Share

PREDICTION MARKETS JUST GOT A FEDERAL STAMP 🚨

The U.S. Commodity Futures Trading Commission says it has full authority over insider trading in event contracts after Kalshi froze traders and flagged two cases.

That is a power grab from state regulators and a clear message to the DOJ.

Why it matters.

If the CFTC wins jurisdiction, prediction markets move from gray zone to federally protected asset class.

Clarity brings institutions.

Institutions bring liquidity.

Watch who controls the rulebook.

The U.S. Commodity Futures Trading Commission says it has full authority over insider trading in event contracts after Kalshi froze traders and flagged two cases.

That is a power grab from state regulators and a clear message to the DOJ.

Why it matters.

If the CFTC wins jurisdiction, prediction markets move from gray zone to federally protected asset class.

Clarity brings institutions.

Institutions bring liquidity.

Watch who controls the rulebook.

- Reward

- like

- Comment

- Repost

- Share

What if Bitcoin's priced IS being suppressed???

Just to give everyone time to get in...

Just to give everyone time to get in...

BTC-2,47%

- Reward

- like

- 1

- Repost

- Share

GateUser-6aca4c9a :

:

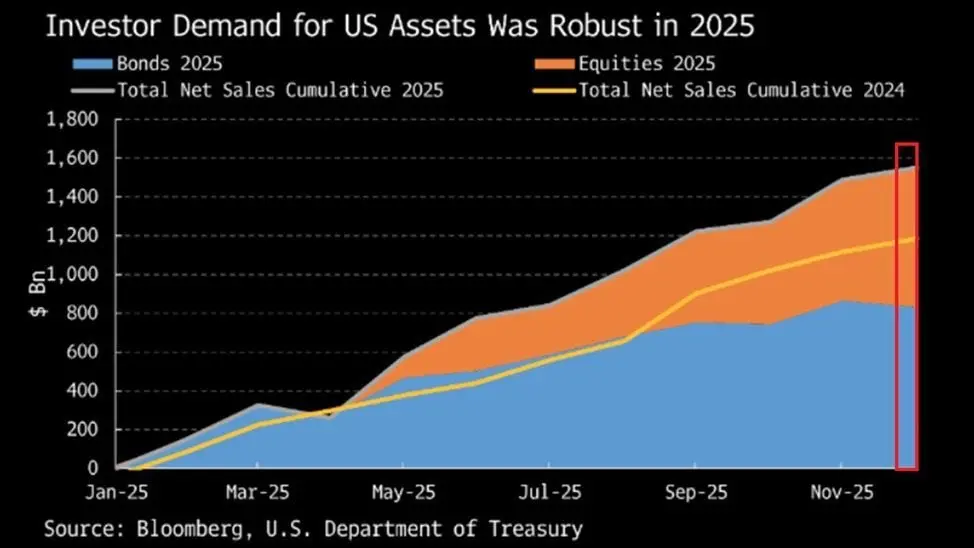

🫡🫡Global capital is flooding into America.

Non US investors bought a record $1.55T in U.S. financial assets in 2025, per the United States Department of the Treasury.

That is up 31% from 2024.

Breakdown:

$720B into equities.

$409B into Treasury notes and bonds.

Europe led with $873B.

Cayman Islands $277B.

Canada $84B.

Japan $56B.

China was the outlier, selling $209B. Its Treasury holdings fell to $684B, the lowest since 2008.

U.S. assets saw net inflows every month except April.

Despite the noise, global money still wants U.S. exposure.

Non US investors bought a record $1.55T in U.S. financial assets in 2025, per the United States Department of the Treasury.

That is up 31% from 2024.

Breakdown:

$720B into equities.

$409B into Treasury notes and bonds.

Europe led with $873B.

Cayman Islands $277B.

Canada $84B.

Japan $56B.

China was the outlier, selling $209B. Its Treasury holdings fell to $684B, the lowest since 2008.

U.S. assets saw net inflows every month except April.

Despite the noise, global money still wants U.S. exposure.

- Reward

- like

- Comment

- Repost

- Share

Stablecoins just moved deeper into the creator economy.

Tether took a strategic stake in Whop, the largest marketplace for digital products and online communities.

Whop will integrate Tether’s Wallet Development Kit to enable self custodial USDT and USA₮ payments across a platform processing $3B in annual creator payouts.

Focus markets: Latin America, Europe, Asia Pacific.

What this means:

Stablecoins are embedding directly into creator income rails.

Faster global payouts. Less reliance on legacy banking.

This is real world distribution for USDT, not just exchange liquidity.

Tether took a strategic stake in Whop, the largest marketplace for digital products and online communities.

Whop will integrate Tether’s Wallet Development Kit to enable self custodial USDT and USA₮ payments across a platform processing $3B in annual creator payouts.

Focus markets: Latin America, Europe, Asia Pacific.

What this means:

Stablecoins are embedding directly into creator income rails.

Faster global payouts. Less reliance on legacy banking.

This is real world distribution for USDT, not just exchange liquidity.

- Reward

- like

- 1

- Repost

- Share

Lions_Lionish :

:

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵When legends MOVE

Spot SUI ETFs are live in the U.S., some with staking. That opens the door for traditional capital, even if day one flows were modest.

Onchain, Sui is leading L1s YTD with roughly $43B in volume.

- Sub second finality.

- Native privacy.

- Stablecoin design that routes fees into SUI buybacks.

Just BUIDL

Spot SUI ETFs are live in the U.S., some with staking. That opens the door for traditional capital, even if day one flows were modest.

Onchain, Sui is leading L1s YTD with roughly $43B in volume.

- Sub second finality.

- Native privacy.

- Stablecoin design that routes fees into SUI buybacks.

Just BUIDL

SUI-4,12%

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More364.11K Popularity

28.41K Popularity

72.93K Popularity

17.18K Popularity

476.61K Popularity

Pin