After 17 years of persistent existence, Bitcoin officially debunks the 'tulip mania myth', according to an ETF expert.

Bitcoin today is no longer suitable for outdated comparisons like the “tulip bubble.” Its resilience and proven staying power over the years have rendered such analogies obsolete, according to Eric Balchunas, ETF specialist at Bloomberg.

“I would never put Bitcoin next to tulips, no matter how bad the selloffs get,” he shared in a commentary on Sunday.

Balchunas emphasized that the tulip bubble soared and then collapsed within about three years, “it only took one blow for it to go down completely.” In contrast, Bitcoin — currently around $89,362 — has survived six or seven major crashes, repeatedly rebounding to set new all-time highs and maintaining its existence for 17 years.

“In my opinion, that resilience alone is enough to end any and all comparisons to tulips. Not to mention, Bitcoin is still up about 250% over the past three years and up 122% in just one year.”

He observed that a segment of the public simply dislikes Bitcoin and often uses such comparisons to mock its supporters, and this tendency is likely to continue.

Not long ago, famed investor Michael Burry — the central figure in the movie “The Big Short” — called Bitcoin the “tulip bulb of this era.” In 2017, JPMorgan CEO Jamie Dimon also criticized Bitcoin as “worse than tulips” and “a fraud.”

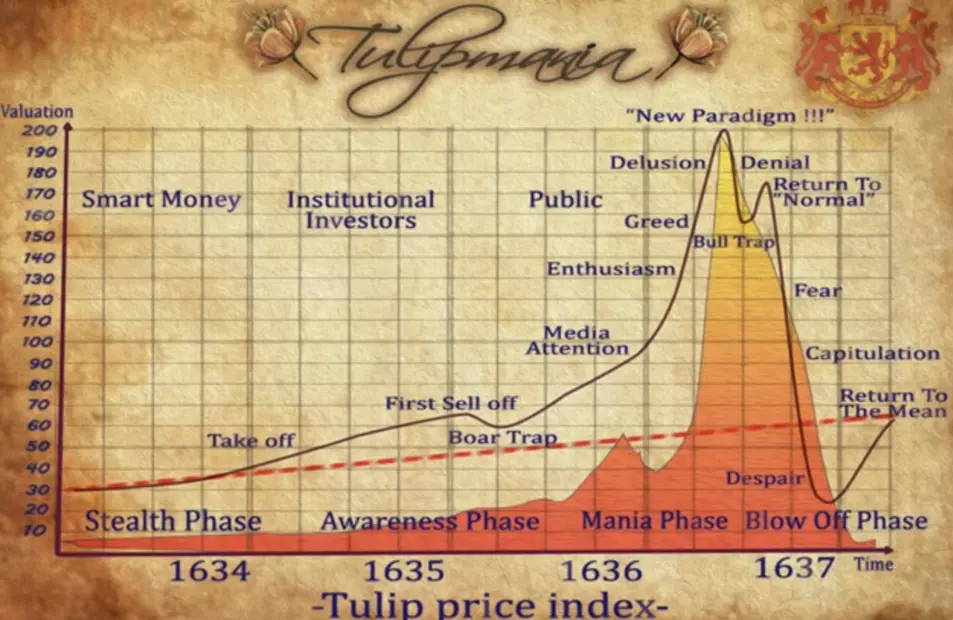

Tulip prices soared and crashed in three years

The tulip mania in the Netherlands was a frenzied speculative phenomenon that took place during the Dutch Golden Age. When tulip bulbs — flowers introduced from Turkey to Europe — quickly became a symbol of luxury among wealthy merchants, their value began to skyrocket uncontrollably.

From 1634, tulip prices rose steeply and peaked in 1636. Some rare tulip bulbs were even traded at prices higher than a house in Amsterdam, sparking an unprecedented speculative frenzy. But it all collapsed in the blink of an eye: in early 1637, the market suddenly plunged, prices dropped by more than 90% in just a few weeks, leaving many speculators in crisis.

Tulip mania is still regarded as one of the earliest recorded speculative bubbles in history, and laid the foundation for the now-famous “pump and dump” (pump and dump) pattern in modern financial markets.

Tulip mania only lasted three years | Source: Eric Balchunas## Bitcoin and tulips: a flawed comparison

Tulip mania only lasted three years | Source: Eric Balchunas## Bitcoin and tulips: a flawed comparison

Balchunas argues that Bitcoin’s performance this year is really just the process of “flushing out the extreme excess” that the market accumulated the previous year. So, even if 2025 ends flat or slightly down, BTC is still moving around its 50% annual average — a completely normal development in a market cycle. According to him, all asset classes, including stocks, go through “cooling off” phases, and investors are tending to “overanalyze” this phenomenon.

He also countered the notion that Bitcoin is an asset with no intrinsic yield. Balchunas emphasized: “Yes, Bitcoin and tulips don’t generate cash flows. But neither does gold, Picasso paintings, or rare stamps — are we going to compare all of those things to tulips? Not every asset needs to be productive to be valuable.” According to him, the tulip bubble was simply a phenomenon created by fleeting euphoria and rapid collapse, while Bitcoin is “a completely different entity.”

In agreement, Garry Krug — Chief Strategy Officer at Bitcoin treasury company Aifinyo (Germany) — stated: “No bubble can last through multiple cycles, overcome legal battles, geopolitical tensions, halvings, exchange collapses… and still come back to set new all-time highs.”

SN_Nour

Related Articles

CPI below expectations boosts Bitcoin prices, BTC firmly holds $70,000 but the bulls and bears are in increased tug-of-war

Bitcoin NUPL drops back into the "Hope/Fear" zone: 0.18 reading signals a shift in market sentiment

How long does it take for Bitcoin to rebound after a 50% drop? Top analysts provide timeframes based on three cycles of history

Bitcoin Slides to 15-Month Low — Is This Key Support Setting Up a Rebound?

Is Bitcoin the Biggest Lie in Crypto? How BTC’s Reality Differs From Early Promises