Cryptocurrencies lag behind gold and stocks, but 2026 presents an opportunity to "catch up"

The cryptocurrency market is expected to continue facing challenges in 2026, even as other major assets record growth. However, according to market analysis platform Santiment, there are still opportunities for cryptocurrencies to regain their position in the new year.

In a social media post on X on Tuesday, Santiment experts noted that Bitcoin is lagging behind gold and the S&P 500 stock index, both of which have recovered slightly after the sharp decline in November.

Since the beginning of November, gold prices have increased by 9%, the S&P 500 has risen by 1%, while Bitcoin has dropped by as much as 20%, trading around $88,000 on Wednesday.

Santiment experts commented: “The correlation between Bitcoin, cryptocurrencies, and other major asset groups remains quite low. Nevertheless, entering 2026, the cryptocurrency market still has a chance to break out and catch up with the trend.”

Whales are waiting for the right moment

According to Santiment, the first sign of a recovery cycle may come from large investors starting to buy back after a period of slow accumulation in the second half of 2025.

“The second half of 2025 saw positive activity from small wallets, while large wallets showed almost no significant movement, only reaching the October high before selling off,” the report stated.

Typically, large investors (whales) are considered those with the ability to influence the market; their trading decisions significantly impact liquidity, sentiment, and investor trends.

Santiment emphasized: “History shows that when large wallets accumulate strongly while small investors sell, it is a precursor for the market to shift from a downtrend to an uptrend.”

Additionally, the amount of Bitcoin held by long-term investors has also stopped decreasing, marking the first time in six months that this coin supply has declined from 14.8 million in mid-July to 14.3 million in December.

Signs of capital flow shifting back to cryptocurrencies

Garrett Jin, former CEO of BitForex exchange, stated that traders have begun shifting capital from other sectors back into the cryptocurrency market.

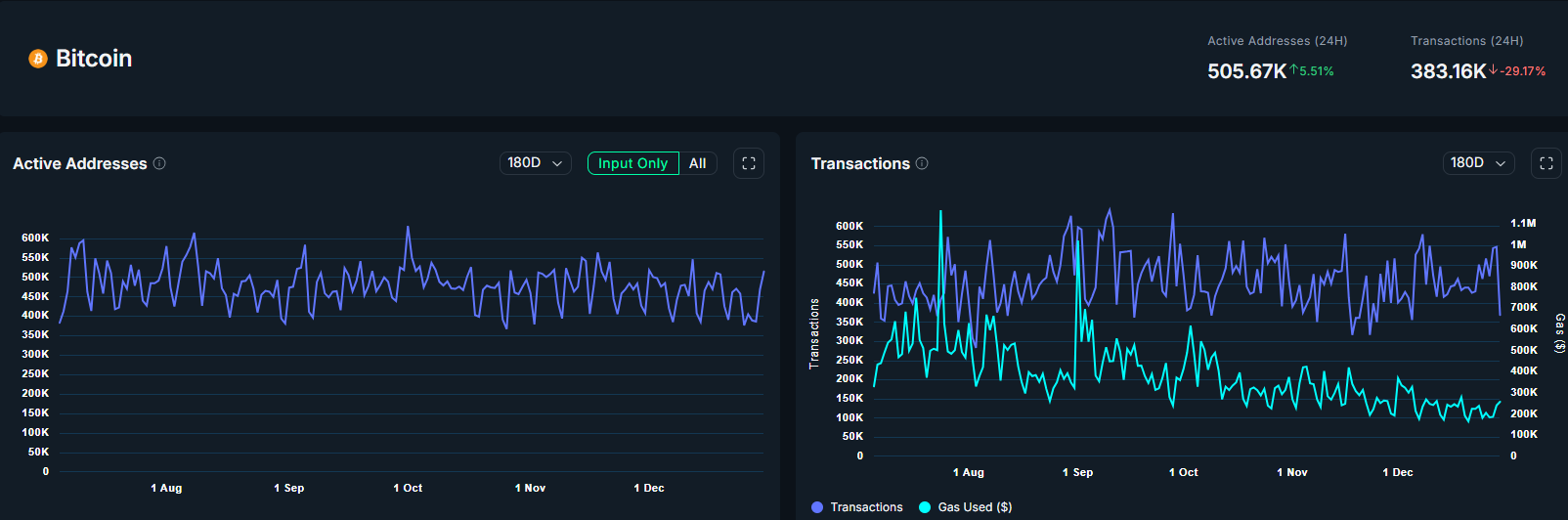

According to on-chain analysis platform Nansen, the number of active Bitcoin addresses increased by 5.51% in just 24 hours, despite transaction volume decreasing by nearly 30%.

The number of active Bitcoin addresses has increased, but transaction volume has decreased | Source: NansenJin said: “The short squeeze in the metals market has ended as predicted. Capital is starting to flow into cryptocurrencies.” When asked whether precious metal investors are buying cryptocurrencies, he replied: “Investment capital always circulates. Selling high and buying low is an unchanging principle.”

The number of active Bitcoin addresses has increased, but transaction volume has decreased | Source: NansenJin said: “The short squeeze in the metals market has ended as predicted. Capital is starting to flow into cryptocurrencies.” When asked whether precious metal investors are buying cryptocurrencies, he replied: “Investment capital always circulates. Selling high and buying low is an unchanging principle.”

Meanwhile, market analyst CyrilXBT shared on X that the market is in a “late cycle positioning phase before a clear shift.”

“When liquidity reverses and Bitcoin breaks the market structure: gold will cool down, Bitcoin will lead the trend, Ethereum will follow, and Altcoins will gradually awaken. The market always moves before the story is fully told. Be patient, because this phase tests investors’ confidence,” CyrilXBT shared.

Mr. Giáo

Related Articles

MicroStrategy Expands Bitcoin Holdings to $50 Billion Despite Market Woes

Bitcoin’s 4-Year Cycle Analysis – Why Analysts Are Eyeing a $50,000 Bottom in 2026