PIPPIN surges 46% in 24 hours: Is the recovery strong enough to regain what was lost?

PIPPIN has officially concluded its correction phase, moving against the overall trend of many other memecoins in the market. This move quickly triggered an impressive recovery on the price chart, helping PIPPIN break out more than 46% within 24 hours.

However, this memecoin has not yet fully regained a sustainable bullish structure. Therefore, the key question is whether the PIPPIN bulls have enough strength to reclaim and maintain the upward trend established since late November.

PIPPIN Strives to Regain Critical Support

The price movement of PIPPIN shows that this memecoin has broken the previous ascending trendline, weakening the bullish structure. At the time of observation, PIPPIN is attempting to return to the support zone it lost, but buying pressure from the bulls remains cautious, not enough to create a convincing breakout.

The MACD indicator has started to turn green after the price bounced from the $0.2251 level — an area that previously saw a liquidity sweep below an important support. Although momentum appears to be improving, with the indicator at 0.17, this still reflects limited trend strength.

Source: TradingView In a positive scenario, if PIPPIN successfully reclaims the key support zone, the price could target the $0.76 level — the next potential high. Conversely, the current rally could merely be a technical rebound to test the old support zone, which has now turned into resistance, paving the way for a deeper correction.

Source: TradingView In a positive scenario, if PIPPIN successfully reclaims the key support zone, the price could target the $0.76 level — the next potential high. Conversely, the current rally could merely be a technical rebound to test the old support zone, which has now turned into resistance, paving the way for a deeper correction.

Therefore, assessing the factors that drove the recent recovery, as well as their impact in the medium and long term, will play a crucial role in determining PIPPIN’s next outlook.

What Has Driven PIPPIN’s Uptrend?

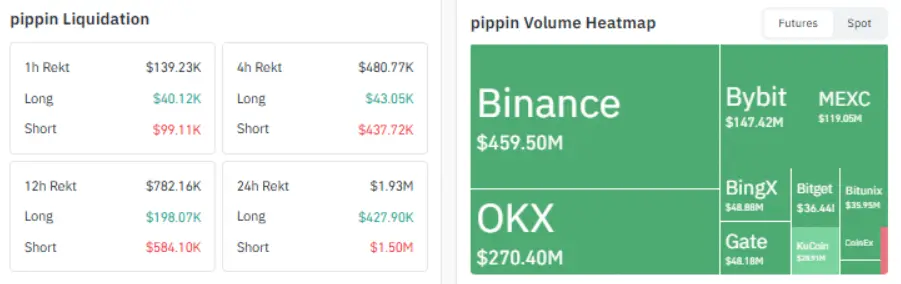

The recent strong rally of PIPPIN mainly stems from a wave of massive short liquidations (Short), with a volume more than three times larger than long position liquidations (Long).

Data from Coinglass shows that over $1.5 million in Short positions have been wiped out, while the liquidation value of Long positions only reached $428,000. This disparity reflects a surge in forced buying pressure, contributing to the rapid price increase of PIPPIN.

The trading volume heatmap continues to reinforce the positive trend, with green dominating clearly. Binance Futures leads the market with a trading volume of up to $459 million, far surpassing other exchanges like OKX, Bybit, MEXC, or BingX — which recorded less than half of this figure. This indicates that capital is heavily concentrated in PIPPIN on major exchanges, providing significant momentum for the altcoin’s rally.

Source: CoinGlass On-chain data from Nansen AI shows that the top 100 wallets increased their holdings to a total of 811 million PIPPIN, a roughly 1.1% increase within 24 hours, indicating clear accumulation signals from large investors.

Source: CoinGlass On-chain data from Nansen AI shows that the top 100 wallets increased their holdings to a total of 811 million PIPPIN, a roughly 1.1% increase within 24 hours, indicating clear accumulation signals from large investors.

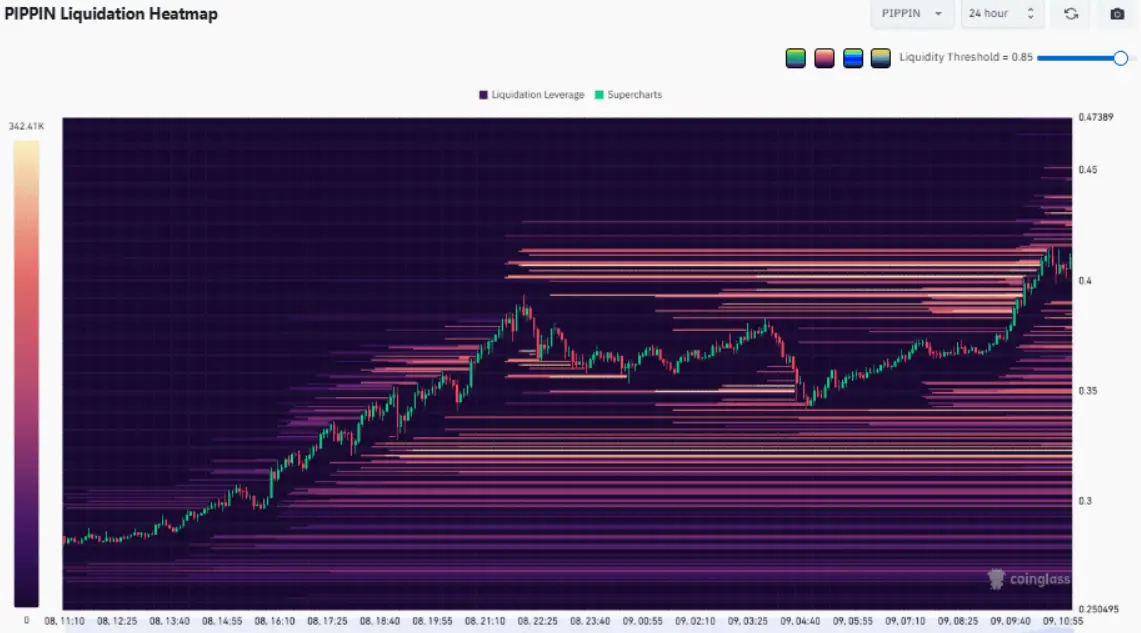

Additionally, the liquidation map confirms that a Short squeeze has contributed to accelerating the rally, especially in the price range of $0.3856 – $0.4143. At the time of writing, new short positions are still forming in the $0.42 – $0.45 zone, posing a risk of further liquidations if the price continues upward.

Source: CoinGlass Conversely, Long positions are being accumulated below the $0.40 level, with the densest liquidity clusters in the $0.31 – $0.35 zone. This is also the area where PIPPIN might return to test if it fails to quickly reclaim the important support levels it has lost.

Source: CoinGlass Conversely, Long positions are being accumulated below the $0.40 level, with the densest liquidity clusters in the $0.31 – $0.35 zone. This is also the area where PIPPIN might return to test if it fails to quickly reclaim the important support levels it has lost.

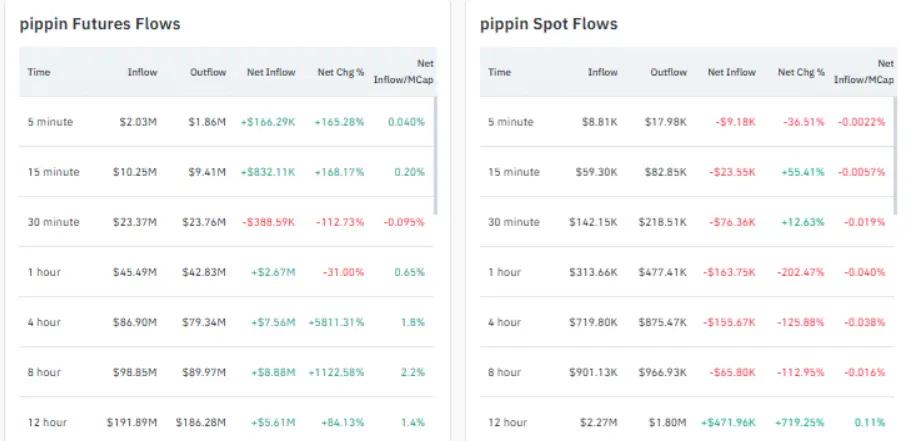

Contrasting Capital Flows Between Futures and Spot Markets

Finally, analyzing the capital flow data reveals a clear divergence between the Futures and Spot markets. Capital in the Futures market remains positive, reflecting optimistic expectations from derivatives traders. In contrast, the Spot market shows less favorable signals, with selling pressure dominating most timeframes, except for the 12-hour chart, which still shows some rare bright spots.

Source: CoinGlass Overall, PIPPIN is entering a “wait-and-see” phase, as the next trend of this memecoin will largely depend on how the price reacts at the critical support zone. The developments in this area are likely to be decisive, determining whether PIPPIN can recover its upward momentum or face the risk of deeper correction.

Source: CoinGlass Overall, PIPPIN is entering a “wait-and-see” phase, as the next trend of this memecoin will largely depend on how the price reacts at the critical support zone. The developments in this area are likely to be decisive, determining whether PIPPIN can recover its upward momentum or face the risk of deeper correction.

Related Articles

Rich Dad: Bought a Bitcoin at 67,000 because the Federal Reserve is printing money like crazy, and BTC is almost mined out.

The PI price loses momentum of recovery amid investor profit-taking.

Analysis: BTC breaks below the key on-chain valuation level and liquidity is tight. Support may be around $54,900.

UniCredit: BTC recovery requires market sentiment and ETF inflows to support; falling below $50,000 may face structural changes

Today, the Fear & Greed Index rose to 8, and the market is in a "Extreme Fear" state.