Litecoin (LTC) Chart Mirrors Monero (XMR) Bullish Path — Could a Breakout Be Next?

Key Highlights

-

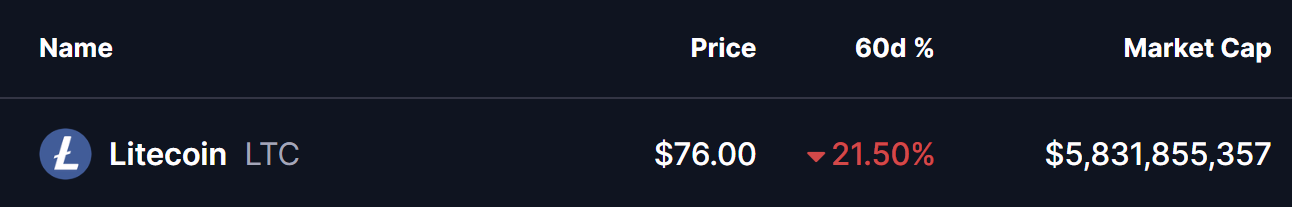

Litecoin (LTC) price has declined nearly 21% in the past 60 days, but its long-term structure remains intact.

-

Weekly and monthly charts show Litecoin closely mirroring Monero’s (XMR) historical bullish fractal.

-

Both LTC and XMR peaked in 2017 and 2021 and formed macro higher lows after the 2022 bear market bottom.

-

LTC is currently testing a long-term rising support trendline near the $75 region.

-

If the fractal continues to play out, Litecoin could be setting up for a larger upside move.

Litecoin (LTC) may have struggled in the short term, but zooming out tells a far more interesting story.

Over the past 60 days, LTC has slipped roughly 21%, reflecting broader market hesitation and declining momentum. However, beneath this pullback, Litecoin’s higher-timeframe structure is beginning to resemble Monero’s (XMR) long-term bullish setup—a fractal that has caught the attention of several analysts.

Source: Coinmarketcap

The comparison suggests that Litecoin could be quietly positioning itself for a larger move, similar to what Monero has already started to deliver.

Litecoin and Monero: A Fractal Years in the Making

According to a weekly chart shared by crypto analyst CryptoBullet, Litecoin’s structure closely mirrors Monero’s historical price behavior across multiple market cycles.

Both assets:

-

Peaked during the same periods in 2017 and again in 2021

-

Printed slightly higher highs during the 2021 cycle

-

Formed macro higher lows following the 2022 bear market bottom

This is a critical observation. Since the 2022 lows, Litecoin has displayed relative strength, maintaining a structure that aligns almost step-by-step with XMR’s longer-term bullish path. Monero has already begun breaking higher from this formation, which raises the question: Is Litecoin simply lagging behind?

XMR and LTC Weekly Fractal Chart/Credits: @CryptoBullet1 (X)

Fractal patterns like these don’t guarantee identical outcomes, but they often highlight market psychology, especially when two assets have matured through multiple cycles.

Monthly Chart Signals: Long-Term Support in Focus

On the monthly timeframe, analyst @_CryptoSurf highlights another important similarity.

Litecoin is currently testing its long-term rising support trendline near the $75 region, the same structural zone that historically marked accumulation phases during prior cycles. This mirrors Monero’s own behavior before its recent upside expansion.

_XMR and LTC Monthly Fractal Chart/Credits: @CryptoSurf (X)

As long as this trendline holds, Litecoin’s broader structure remains intact. Prolonged consolidation at macro support often precedes volatility expansion, particularly when supply pressure dries up after extended drawdowns.

What Could Come Next for Litecoin (LTC)?

If the fractal comparison continues to play out, Litecoin may be approaching the later stages of its base formation.

Monero’s breakout followed:

-

Years of compression

-

A confirmed macro higher low

-

A clean push above long-standing resistance of $375.

For Litecoin, a similar roadmap would imply that the current consolidation phase could be a prelude to an upside rally, rather than a sign of weakness. The upper long-term trendline—currently far above price—stands out as the next major technical magnet if bullish momentum returns.

That said, structural support around $75 remains critical. Losing this level would weaken the fractal comparison and delay any bullish scenario.

Bottom Line

Despite recent downside pressure, Litecoin’s higher-timeframe structure suggests the correction may be part of a broader accumulation phase. The strong fractal similarity with Monero’s bullish path indicates that LTC could be lagging rather than weakening. As long as the $75 macro support holds, Litecoin may be positioning itself for a potential breakout in the coming cycle.

Frequently Asked Questions (FAQ)

Is Litecoin following Monero’s bullish price pattern?

Yes, Litecoin’s weekly and monthly charts show a strong fractal similarity to Monero, including shared cycle highs in 2017 and 2021 and a macro higher low formed after the 2022 bear market.

Why is the $75 level important for Litecoin?

The $75 region aligns with Litecoin’s long-term rising support trendline. Holding this level keeps the bullish higher-timeframe structure intact.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

Ethereum Forms Bearish Pennant as $2,100 Breakout or $1,850 Breakdown Looms

Forget M2: Treasury T-Bill Issuance Emerges as Bitcoin’s Strongest Macro Signal

Rich Dad: Bought a Bitcoin at 67,000 because the Federal Reserve is printing money like crazy, and BTC is almost mined out.

The PI price loses momentum of recovery amid investor profit-taking.

Analysis: BTC breaks below the key on-chain valuation level and liquidity is tight. Support may be around $54,900.