Chainlink (LINK) Chart Hasn’t Looked This Bullish Since 2021 Cycle Top

Chainlink price action has started telling a familiar story again, one that long-term chart watchers remember from earlier cycles. LINK price has spent months moving sideways, absorbing pressure and shaking out weak hands. Recent structure changes now suggest that this quiet phase may be giving way to something more directional. The chart looks calm on the surface, yet the deeper signals show growing strength underneath.

The current LINK price analysis focuses on where price is holding rather than how fast it moves. That distinction matters during macro transitions, especially when a market shifts from survival mode into recovery.

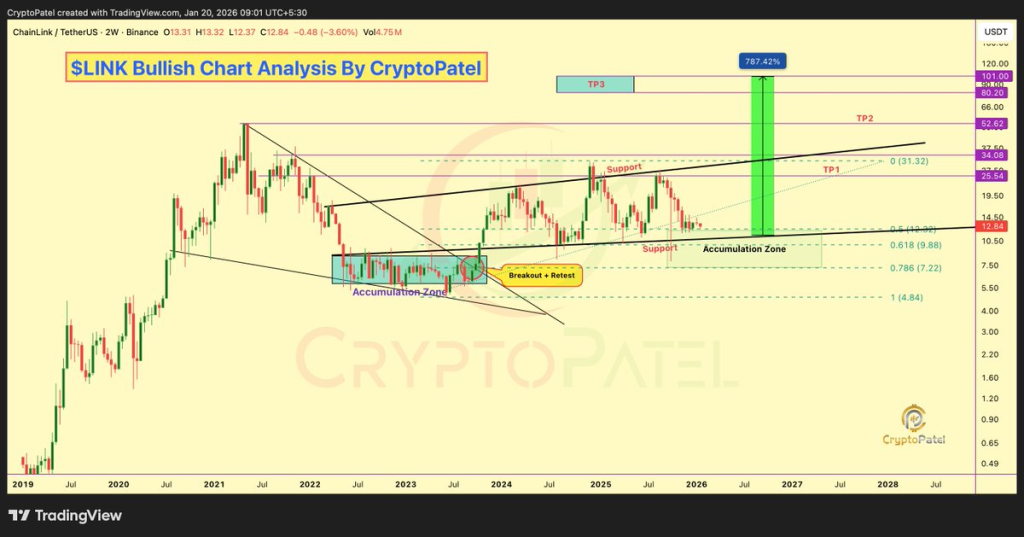

Crypto Patel, a popular crypto analyst on X, explains that LINK price is sitting inside a support zone that has played a major role since the previous cycle top. The two-week chart shows Chainlink price holding above a key Fibonacci region near $9.88, a level tied to the 0.618 retracement. Price continues to form higher lows, a structural change that often appears before trend reversals gain momentum.

Crypto Patel has highlighted how this structure resembles the early recovery phase seen after the 2021 peak. His Chainlink price prediction points to the importance of the range between $10 and $7 as a long-term accumulation area rather than a breakdown zone. LINK price remaining above this region keeps the broader bullish structure intact.

LINK Price Chart

LINK price analysis also focuses on the breakout and retest pattern that has already played out. Price pushed above long-standing resistance, pulled back to test former supply, and then stabilized. That behavior often signals acceptance rather than rejection.

According to Crypto Patel, this phase reflects accumulation rather than distribution. The gradual compression under resistance has allowed LINK to reset momentum while preserving its macro structure. Chainlink price has not shown the kind of impulsive downside that usually precedes deeper corrections, which strengthens the bullish case as long as structure remains intact.

Chainlink Price Prediction Gains Context From On Chain Data

On chain data adds another layer to the Chainlink price prediction narrative. Data from Santiment shows top LINK holding wallets increasing exposure below $13. That trend suggests long term positioning rather than short term speculation.

Chart Showing LINK Token Accumulation

Crypto Patel often emphasizes that accumulation phases tend to feel uneventful while they are happening. LINK price action currently reflects that behavior, with slow movement masking the broader shift in ownership. Chainlink price strength becomes more meaningful when combined with stable on-chain trends rather than isolated price spikes.

LINK Price Faces Expansion Triggers And Clear Risk Levels

LINK price now sits below a resistance band between $25 and $31, an area that could act as an expansion trigger if reclaimed. Crypto Patel outlines higher cycle targets near $31, $52, and $100 if momentum continues to build. Those projections remain conditional and depend on LINK price holding above the broader Fibonacci support zone.

India Goes All-In on Silver as Metal Stocks Explode to 11-Year Highs_**

Risk remains defined as well. A weekly close below $7 would weaken the macro structure and force a reassessment of the Chainlink price prediction narrative.

Chainlink price continues to trade at a point where patience matters more than speed. LINK price structure suggests something is developing, even if the chart has not fully revealed its hand yet. Watching how price behaves around resistance may offer clearer answers in the weeks ahead.

Related Articles

NBA retired star Pippen posts to reaffirm his faith in Bitcoin

HYPE Token Faces Critical Crossroads After Significant Decline

Bear market nearing the end! K33 Research: Bitcoin will enter a "long period of consolidation" with little chance of a major rally in the short term

Data: Retail investors continue to increase their Bitcoin holdings, but whale sell-offs may suppress rebound potential

Ethereum Forms Bearish Pennant as $2,100 Breakout or $1,850 Breakdown Looms

Forget M2: Treasury T-Bill Issuance Emerges as Bitcoin’s Strongest Macro Signal