Is Pump.fun (PUMP) Coiling Up for a Bullish Breakout? This Key Pattern Formation Suggests So!

Key Highlights

-

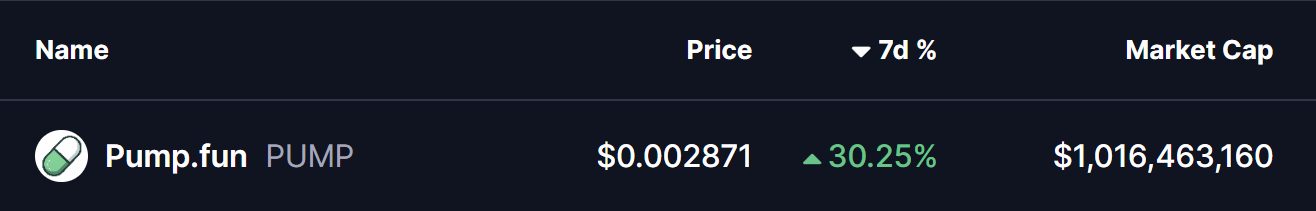

PUMP rallies 30% in one week, showing improving momentum

-

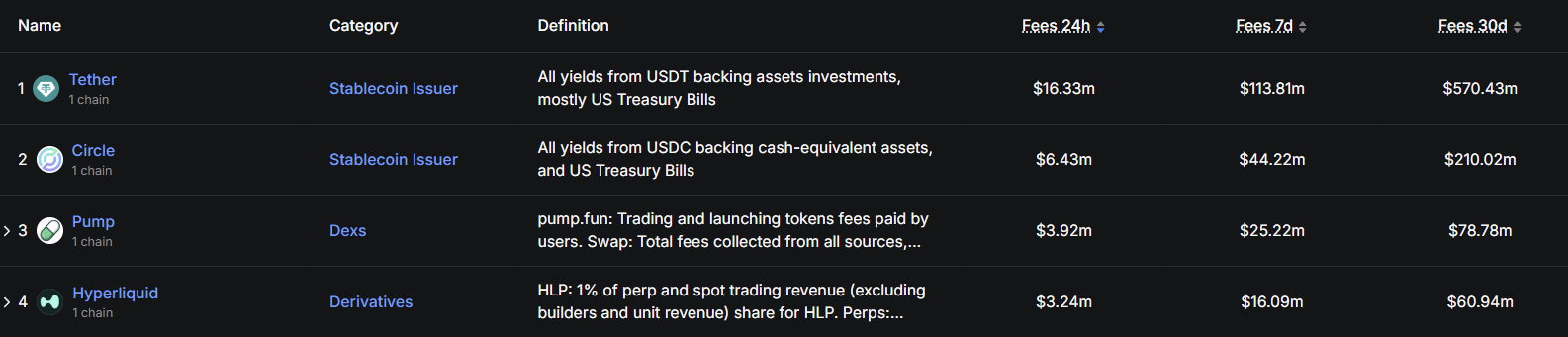

Pump.fun ranks 3rd in protocol fees with $78.78M in 30 days

-

Rounding bottom pattern forms on daily chart

-

Price reclaimed 50-day moving average, shifting trend bias

-

Breakout above $0.00310–$0.00339 could unlock 76% upside

Pump.fun (PUMP), the native token of the popular Solana-based launchpad protocol, is quietly turning heads in the crypto market. Over the past week, PUMP has surged by nearly 30%, supported by strong on-chain growth and a noticeable improvement in price structure.

Source: Coinmarketcap

While broader market momentum has helped — with Bitcoin and Ethereum holding firm — PUMP’s recent move appears to be more than just a sympathy rally. Both fundamental metrics and technical structure are beginning to align, raising the possibility that the token may be preparing for a larger upside move if a key breakout level is cleared.

On-Chain Momentum Is Building

Beyond price action, Pump.fun’s protocol activity has been accelerating at an impressive pace. According to DefiLlama, Pump.fun ranked as the third-highest fee-generating crypto protocol over the past 30 days, recording approximately $78.78 million in fees.

Source: Defillama

This places Pump.fun ahead of major players like Hyperliquid and just behind stablecoin giants such as Tether and Circle. Consistently high fee generation signals sustained user demand, strong protocol usage, and growing economic relevance — all of which often precede longer-term price expansions.

Rounding Bottom Pattern Takes Shape

From a technical perspective, PUMP’s daily chart is now printing a rounding bottom pattern, a classic bullish reversal structure that typically forms after prolonged downtrends and extended accumulation phases.

The pattern began taking shape after PUMP was rejected near the $0.003396 region late last month. That rejection led to a sharp sell-off, pushing price down toward the $0.0017 area. However, sellers gradually lost control at those lows, and downside momentum faded.

Over time, price action stabilized, volatility compressed, and PUMP began to curve higher — forming the smooth, rounded base that characterizes this pattern and recently PUMP reclaimed its 50-day moving average near $0.002453, a level that had previously acted as resistance. Since then, price structure has improved, and higher lows have continued to form.

Pump.fun (PUMP) Daily Chart/Coinsprobe (Source: Tradingview)

At present, PUMP is trading around $0.002875 and is pressing into a well-defined resistance zone between $0.003107 and $0.003396. This zone represents the neckline of the rounding bottom pattern and has capped upside attempts multiple times in the past — making it the most important area to watch.

What’s Next for PUMP?

If PUMP can secure a clean daily close above the $0.003107–$0.003396 resistance zone, it would confirm a breakout from the rounding bottom formation. A successful breakout followed by a retest of this zone as support would significantly strengthen the bullish case and suggest that a new upward leg is underway.

Based on the depth of the rounding structure, the measured move projection points toward the $0.005092 region. From current levels, this would represent a potential upside of roughly 76%, aligning well with typical post-breakout expansions seen in this pattern.

That said, patience remains key. Until confirmation occurs, short-term pullbacks — including a dip toward the rising base of the rounding structure — remain possible. Such moves would not invalidate the bullish setup as long as price continues to hold above higher-low support levels.

Bottom Line

Pump.fun is currently sitting at a critical inflection point. Strong on-chain fee growth, improving market structure, and a well-defined bullish reversal pattern all suggest that PUMP may be positioning for a larger move — provided bulls can reclaim and hold the neckline resistance.

For now, the $0.003107–$0.003396 zone remains the line in the sand. How price behaves around this level will likely determine whether PUMP transitions into a sustained bullish phase or remains range-bound for longer.

Frequently Asked Questions (FAQ)

What is Pump.fun (PUMP)?

Pump.fun is a Solana-based token launchpad protocol designed to simplify the creation and trading of new crypto tokens.

Why is PUMP price rising?

PUMP is gaining momentum due to strong on-chain fee growth, increased user activity, and a bullish rounding bottom pattern forming on the chart.

What bullish pattern is forming on PUMP?

PUMP is forming a rounding bottom pattern, which often signals a trend reversal after prolonged consolidation.

What is the key resistance level for PUMP?

The critical resistance zone lies between $0.003107 and $0.003396. A breakout above this range could confirm bullish continuation.

What is the upside target for PUMP?

If the breakout is confirmed, the projected target stands near $0.005092, representing roughly 70–76% upside from current levels.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

Data: Retail investors continue to increase their Bitcoin holdings, but whale sell-offs may suppress rebound potential

Ethereum Forms Bearish Pennant as $2,100 Breakout or $1,850 Breakdown Looms

Forget M2: Treasury T-Bill Issuance Emerges as Bitcoin’s Strongest Macro Signal

Rich Dad: Bought a Bitcoin at 67,000 because the Federal Reserve is printing money like crazy, and BTC is almost mined out.

The PI price loses momentum of recovery amid investor profit-taking.

Analysis: BTC breaks below the key on-chain valuation level and liquidity is tight. Support may be around $54,900.