Hyperliquid (HYPE) Dips Hard — But Could This Emerging Pattern Trigger a Rebound?

Key Takeaways

-

Hyperliquid (HYPE) has dropped over 19% on the week, with price stabilizing near a critical demand zone.

-

The $19.22–$19.55 support area is emerging as a key level where sellers may lose control.

-

A bearish Shark harmonic pattern is forming on the daily chart, hinting at a potential rebound if support holds.

-

Strong token burns and notable whale buying are acting as a contrarian signal amid broader weakness.

-

A reclaim of the 50-day moving average near $26.39 could confirm a bullish recovery phase.

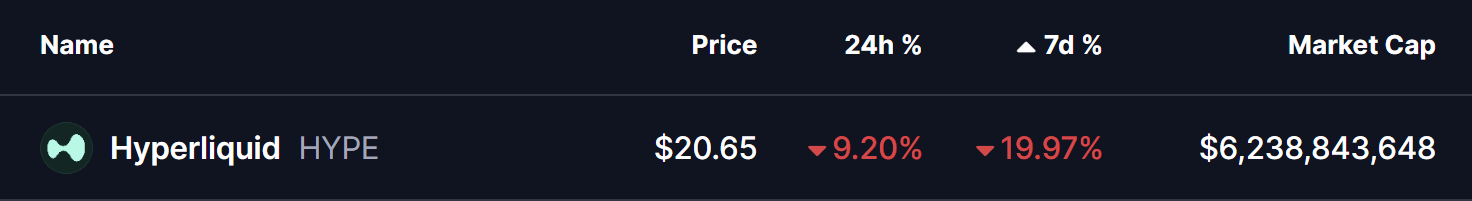

Hyperliquid’s native token, HYPE, remains under sustained selling pressure as bearish momentum continues to dominate short-term price action. As of January 21, HYPE is trading nearly 9% lower on the day, extending its weekly decline to over 19%. The token is currently hovering around the $20.65 region, an area that is quickly becoming a decisive technical battleground.

While the chart reflects heavy downside pressure, a mix of aggressive supply reduction, strategic buying, and an emerging harmonic structure is raising the question: Is a rebound quietly setting up beneath the surface?

Source: Coinmarketcap

Burn and Buying Add a Contrarian Signal

Despite the ongoing price weakness, on-chain activity tells a more nuanced story.

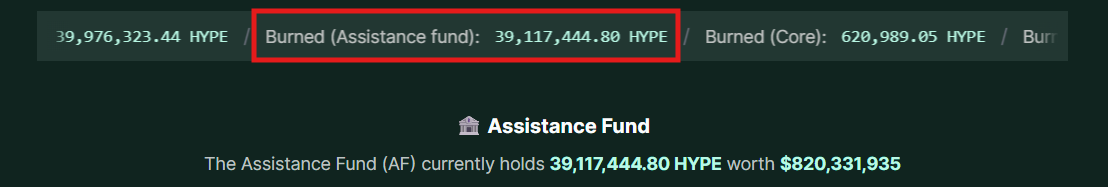

As of January 21, Hyperliquid’s assistance fund burned 39 million HYPE tokens, permanently removing roughly 3.9% of the maximum supply from circulation. At the same time, notable buyers stepped in during the sell-off.

Source: hypeburn

-

Arthur Hayes reportedly purchased** 19,000 HYPE**

-

The assistance fund itself continues to buy aggressively, paying prices over 50% higher than current market levels

This combination of sustained burning and dip-buying suggests growing long-term conviction, even as short-term sentiment remains fragile.

Could This Emerging Pattern Trigger a Rebound?

From a technical perspective, the daily chart shows HYPE entering the early stages of a bearish Shark harmonic pattern.

After completing the O-X-A leg, price rolled over and is now pressing toward the projected B-point support zone between $19.22 and $19.55. This area is highlighted on the chart as a historically reactive demand zone and could mark a potential exhaustion point for sellers.

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview)

If buyers step in around this support and price begins to stabilize, the next key technical hurdle would be a reclaim of the 50-day moving average near $26.39. A decisive move back above this level would strengthen the rebound thesis and open the door for a recovery move toward the C-point near $38.7, where the Shark pattern’s projected extension sits around the 1.13 level.

What’s Next for HYPE?

For now, the pattern remains in development, not confirmed. The coming sessions will be critical.

-

Holding the $19.22–$19.55 zone would keep the harmonic setup alive

-

Rising volume and stronger daily closes could signal buyer commitment

-

A break back above the 50-day MA would act as early confirmation of a trend shift

On the downside, a failure to hold the lower support zone would invalidate the pattern and leave HYPE vulnerable to deeper consolidation.

For now, Hyperliquid sits at a technical inflection point, where intense selling pressure collides with supply destruction and early structural support. Whether this develops into a meaningful rebound or another leg lower will depend on how price reacts at the lower boundary in the days ahead.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

10x Research: Altcoin Market Is Fragile and Bitcoin Is Oversold, but Positioning Structure Is Quietly Changing

"Has the 'true bottom' not arrived yet? Experts warn: Bitcoin may face a 'surrender sell-off' in the final dip"

Cardano Faces Key Support Test at $0.244 Amid Market Uncertainty

Bottoming out and aiming for a rebound by the end of the year! Standard Chartered predicts: Bitcoin may drop to $50,000, and Ethereum could fall to $1,400

Alt-Season Is Starting Now: Top 5 Altcoins Positioned for 2x–4x Returns as Bitcoin Loses Dominance

The Clarity Act – a Potential ETH Super-Cycle Trigger As Prediction Markets Signal 90% Approval Odds