When global assets are celebrating, why is it only the crypto world that is "wintering"?

2025 Year Gold Surges 60%, Silver Explodes 210%, US Stocks Hit New Highs, But Bitcoin Falls Below $90,000. As global assets take turns rising, why does cryptocurrency remain silent? What market warning signals are hidden behind this? This article is based on a piece by EeeVee, organized, translated, and written by BlockBeats.

(Previous summary: Trump at Davos states: The US will not seize Greenland by force! Gold drops $40, Bitcoin rebounds past $89,000)

(Additional background: US government no longer selling Bitcoin! Basent announces transfer of 200,000 BTC into “strategic reserves”)

Table of Contents

- Why is Bitcoin so weak?

- Leading indicators

- Liquidity tightening

- Geopolitical conflicts

- Why aren’t other assets falling?

- Will history repeat itself?

- Can we still chase other assets now?

Recently, the crypto world and other global markets seem to be experiencing two extremes—ice and fire.

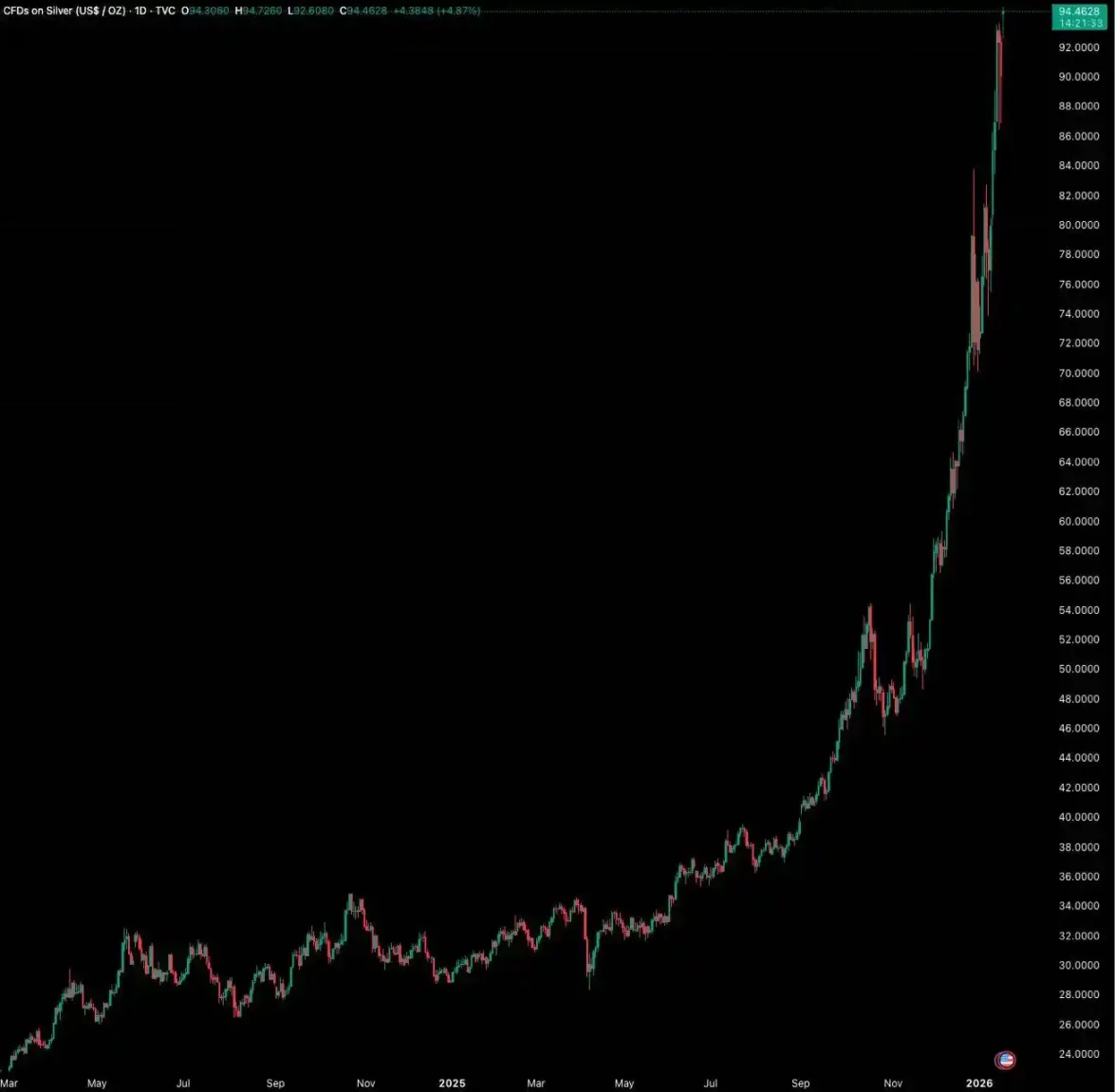

In 2025, gold rose over 60%, silver skyrocketed 210.9%, and the Russell 2000 index of US stocks increased by 12.8%. Meanwhile, Bitcoin, after a brief new high, closed the year with a downward trend.

At the start of 2026, divergence continues to intensify. On January 20, gold and silver hit new highs again, the Russell 2000 outperformed the S&P 500 for 11 consecutive days, and the ChiNext 50 index in China surged over 15% in a single month.

In contrast, Bitcoin on January 21 experienced six consecutive declines, dropping from $98,000 back below $90,000 without hesitation.

Silver’s performance over the past year

Funds seem to have decisively exited the crypto space after 1011, with BTC oscillating below $100,000 for over three months, marking a period of “lowest volatility in history.”

Disappointment has spread among crypto investors. When asked about making money in other markets after leaving crypto, they even share the “secret”—“Anything But Crypto”—as long as they avoid investing in crypto, they can profit elsewhere.

The long-anticipated “Mass Adoption” now seems to have arrived. But it’s not the widespread adoption of decentralized applications everyone hoped for; instead, it’s a Wall Street-led, thorough “assetization.”

This cycle, the US establishment and Wall Street are embracing crypto like never before. The SEC approves spot ETFs; BlackRock and JPMorgan allocate assets to Ethereum; the US includes Bitcoin in its national strategic reserves; several state pension funds invest in Bitcoin; even the NYSE plans to launch a cryptocurrency trading platform.

So, the question is: why, after Bitcoin receives so much political and capital endorsement, does its price perform so disappointingly compared to the record highs in precious metals and stocks?

As crypto investors have become accustomed to analyzing US stock prices before market opens to gauge crypto trends, why is Bitcoin no longer rising in tandem?

Why is Bitcoin so weak?

Leading indicators

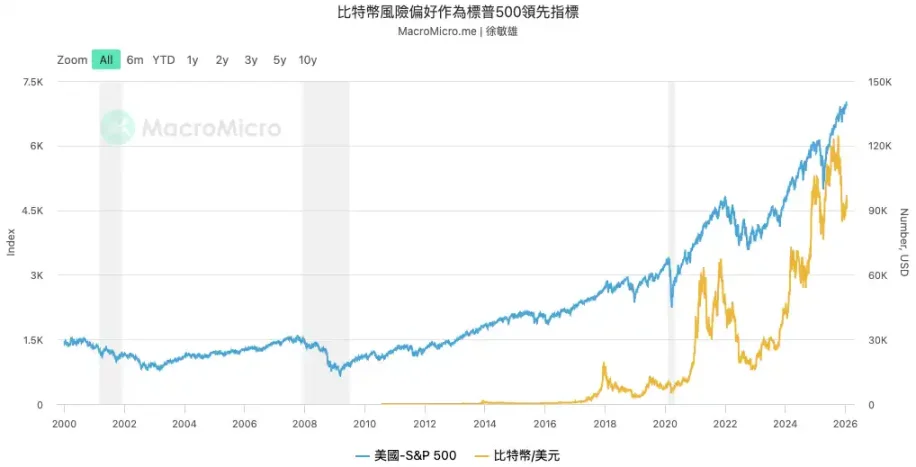

Bitcoin is a “leading indicator” of global risk assets. Raoul Pal, founder of Real Vision, repeatedly mentions this in many articles because Bitcoin’s price is purely driven by global liquidity, unaffected directly by any country’s financial reports or interest rates. Therefore, its volatility often leads mainstream risk assets like the Nasdaq.

According to MacroMicro data, Bitcoin’s turning points over the past few years have often preceded the S&P 500’s. Therefore, when Bitcoin’s upward momentum stalls and it can no longer reach new highs, it sends a strong warning signal that the upward momentum of other assets may also be nearing exhaustion.

Liquidity tightening

Secondly, Bitcoin’s price to date remains highly correlated with the net liquidity of the global US dollar. Although the Federal Reserve cut interest rates in 2024 and 2025, the quantitative tightening (QT) that began in 2022 continues to drain liquidity from the market.

Bitcoin’s new highs in 2025 were mainly driven by ETF inflows bringing in new funds, but this did not change the fundamental macro liquidity tightness. Bitcoin’s sideways movement is a direct response to this macro reality. In a liquidity-scarce environment, it’s difficult to trigger a super bull market.

The world’s second-largest liquidity source—the Japanese yen—also began to tighten. In December 2025, the Bank of Japan raised short-term policy rates to 0.75%, the highest in nearly 30 years. This directly impacted a key source of global risk asset funding: yen carry trades.

Historical data shows that since 2024, three rate hikes by the Bank of Japan have been accompanied by Bitcoin dropping over 20%. The synchronized tightening by the Fed and BOJ worsens the global liquidity environment.

Japanese rate hikes and Bitcoin declines

(# Geopolitical conflicts

Finally, potential “black swan” geopolitical events keep markets on edge, and Trump’s series of domestic and international actions in early 2026 have pushed this uncertainty to a new level.

Internationally, Trump’s government actions are unpredictable—from military intervention in Venezuela and unprecedented arrest of its president )in modern international relations###, to the renewed threat of war with Iran; from attempting to buy Greenland to issuing new tariffs against the EU. These aggressive unilateral moves are intensifying major power conflicts.

Domestically, his actions have sparked deep concerns about constitutional crises. He proposed renaming the Department of Defense to the “Department of War” and ordered active-duty troops to prepare for potential domestic deployment.

These moves, combined with hints that he regrets not using military force to intervene and his reluctance to accept midterm election defeat, are fueling fears: will he refuse to accept the midterm results and use force to stay in power? Such speculation and high pressure are exacerbating internal US tensions, with protests expanding across the country.

Last week, Trump invoked the Insurrection Act and deployed troops to Minnesota to quell protests. The Pentagon has also ordered about 1,500 active-duty soldiers in Alaska on standby.

This normalization of conflict is dragging the world into a “gray zone” between localized war and a new Cold War. Traditional full-scale hot war still has a relatively clear path and market expectations, even accompanied by liquidity injections to “rescue the market.”

But these localized conflicts carry extreme uncertainty, full of “unknown unknowns” (unknown unknowns). For risk capital markets that rely heavily on stable expectations, this uncertainty is deadly. When large capital cannot judge future directions, the most rational choice is to hold cash and wait, rather than allocate funds to high-risk, high-volatility assets.

( Why aren’t other assets falling?

Contrasting sharply with the crypto silence, since 2025, markets like precious metals, US stocks, and Chinese A-shares have taken turns rising. But these gains are not due to improved macro or liquidity fundamentals; instead, they are structural trends driven by sovereign will and industrial policies amid great power rivalries.

Gold’s rise reflects responses from sovereign nations to the existing international order, rooted in cracks in the dollar system’s credibility. The 2008 global financial crisis and the 2022 freezing of Russia’s foreign exchange reserves shattered the myth of US Treasuries and gold as risk-free, ultimate reserve assets. In this context, central banks worldwide have become “price-insensitive buyers.” They buy gold not for short-term profit but as an ultimate store of value independent of any sovereign credit.

Data from the World Gold Council shows that in 2022 and 2023, global central banks net purchased over 1,000 tons of gold for two consecutive years, setting a record. This gold rally is mainly driven by official sector activity, not market speculation.

![])https://img-cdn.gateio.im/social/moments-d30543aedd-7bfcb64fb6-8b7abd-e2c905###

Central bank gold vs. US Treasuries reserves, 2025: total gold reserves surpass US Treasuries

Stock market gains are manifestations of national industrial policies. Whether it’s the US “AI national strategy” or China’s “industrial independence” policy, these are deep government interventions shaping capital flows.

In the US, the “Chips and Science Act” has elevated AI to a strategic national security level. Capital is flowing out of large tech stocks and into more growth-oriented, policy-aligned small and mid-cap stocks.

In China’s A-share market, funds are also concentrated in “Xinchuang” (core technology innovation) and “defense and military” sectors closely related to national security and industrial upgrading. This government-led trend has a valuation logic fundamentally different from Bitcoin, which relies purely on market liquidity.

( Will history repeat?

Historically, Bitcoin has not been the first asset to diverge from other assets. And every divergence has ultimately ended with a strong rebound in Bitcoin.

Historically, the RSI )Relative Strength Index### of Bitcoin relative to gold has fallen below 30 in four instances: 2015, 2018, 2022, and 2025.

Each time Bitcoin was extremely undervalued relative to gold, it foreshadowed a rebound in the exchange rate or Bitcoin’s price.

Historical trend of Bitcoin / Gold, RSI indicator at the bottom

In 2015, during the end of a bear market, Bitcoin’s RSI relative to gold fell below 30, then triggered a super bull run in 2016-2017.

In 2018, during a bear market, Bitcoin dropped over 40%, while gold rose nearly 6%. After RSI fell below 30, Bitcoin rebounded from its 2020 lows, gaining over 770%.

In 2022, during a bear market, Bitcoin fell nearly 60%. After RSI dropped below 30, Bitcoin rebounded again, outperforming gold.

Since late 2025, we are witnessing the fourth occurrence of this historic oversold signal. Gold surged 64% in 2025, and Bitcoin’s RSI relative to gold again entered the oversold zone.

( Can we still chase other assets now?

Amid the “ABC” hype, selling crypto assets easily to chase seemingly more prosperous markets may be a risky decision.

When small-cap US stocks start leading, historically, it’s often the last rally before liquidity dries up at the end of a bull market. The Russell 2000 has risen over 45% since its 2025 lows, but most of its constituent stocks have poor profitability and are highly sensitive to interest rate changes. If the Fed’s monetary policy is less dovish than expected, these vulnerabilities will quickly surface.

Second, the frenzy around AI stocks shows typical bubble characteristics. Whether from Deutsche Bank’s survey or Ray Dalio’s warnings, the AI bubble is listed as the biggest market risk for 2026.

Valuations of star companies like Nvidia and Palantir have reached historic highs, but whether their earnings growth can support such valuations is increasingly questioned. Deeper risks include AI’s massive energy consumption potentially triggering new inflation pressures, forcing central banks to tighten monetary policy and bursting asset bubbles.

According to a January survey by Bank of America )Bank of America###, global investor optimism has hit a new high since July 2021, with growth expectations soaring. Cash holdings have fallen to a record low of 3.2%, and hedging measures against market corrections are at their lowest since January 2018.

On one side, wildly rising sovereign assets and widespread investor optimism; on the other, escalating geopolitical conflicts.

In this context, Bitcoin’s “stagnation” is not simply “underperforming the market.” It’s more like a clear signal—an early warning of larger risks ahead, and a buildup for a broader narrative shift.

For true long-term believers, this is precisely the moment to test their convictions, resist temptations, and prepare for upcoming crises and opportunities.

(##

Related Articles

Analysis: BTC breaks below the key on-chain valuation level and liquidity is tight. Support may be around $54,900.

UniCredit: BTC recovery requires market sentiment and ETF inflows to support; falling below $50,000 may face structural changes

Today, the Fear & Greed Index rose to 8, and the market is in a "Extreme Fear" state.

10x Research: Altcoin Market Is Fragile and Bitcoin Is Oversold, but Positioning Structure Is Quietly Changing

"Has the 'true bottom' not arrived yet? Experts warn: Bitcoin may face a 'surrender sell-off' in the final dip"