2026 is a watershed year! Ripple President: Half of Fortune 500 companies will implement crypto asset strategies

Ripple CEO predicts 2026 will mark the “production era” in the crypto industry, with nearly half of the Fortune 500 companies developing digital asset strategies, where stablecoins, custody, and AI automation become key.

Digital assets enter the production era, with half of Fortune 500 companies planning crypto strategies

According to recent blog and social media posts by Ripple CEO Monica Long, 2026 will be seen as a critical watershed for the cryptocurrency industry, symbolizing a shift from speculation-driven to real-world applications—the “production era.”

Long points out that as blockchain technology gradually evolves into the “operational layer” of modern finance, by the end of 2026, approximately 50% of Fortune 500 companies (about 250 giants) in the U.S. will officially have exposure to cryptocurrencies or develop comprehensive digital asset strategies.

This prediction is not unfounded; Long cites mid-2025 survey data indicating that 60% of senior executives reported their companies were actively investing in blockchain initiatives. Current market practices also confirm this trend, including Tesla, Block Inc., and GameStop, which purchased 4,710 BTC in May 2025, all of which have incorporated digital assets into their balance sheets.

Long emphasizes that future participation will be more diverse, not limited to asset holdings but also including active involvement in tokenizing physical assets, digital asset treasuries (DAT), on-chain government bonds, and programmable financial instruments.

Stablecoins Reshape Global Settlement, Unlocking $700 Billion in Troubled Capital?

In Monica Long’s blueprint, stablecoins will evolve from being an alternative payment method to becoming the infrastructure of the global settlement system. As payment giants like Visa, Mastercard, and Stripe deeply embed digital currencies into their existing payment flows, B2B settlements will become a primary growth driver. Through the application of digital dollars, companies can achieve real-time liquidity management and maximize capital efficiency without manual intervention.

Long specifically mentions that this shift could generate tangible economic benefits, potentially unlocking up to $700 billion in “trapped operational funds” worldwide.

Additionally, regulatory improvements are a key catalyst. For example, the passage of the U.S. GENIUS Act is seen by Long as officially ushering in a new era for digital dollars. While some XRP holders worry about the dominance of stablecoins, market observers believe that the widespread adoption of fiat-backed tokens will increase demand for neutral bridging assets like $XRP in cross-border exchanges and interoperability.

Financial Institutions’ Custody to Enter a New Warring Era

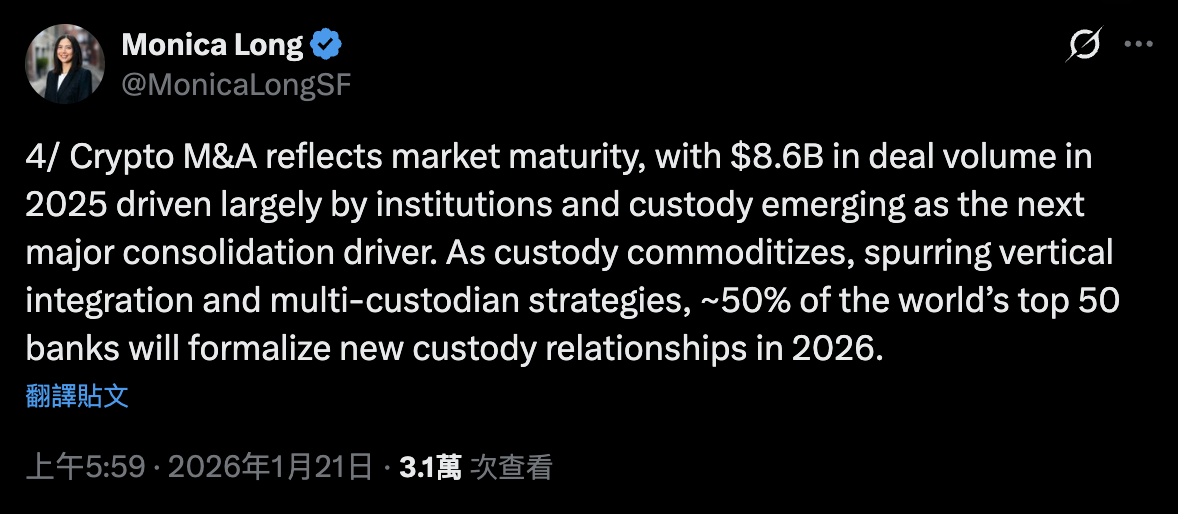

With institutional funds pouring in, security and custody services for digital assets will become another major focus in 2026. Long predicts that the total value of digital assets on global balance sheets will surpass $1 trillion. To cope with this wave, about 50% of the top 50 banks worldwide are expected to establish formal crypto custody agreements by 2026.

Image source: X/@MonicaLongSF Ripple CEO Monica Long predicts that about 50% of the top 50 banks globally will establish formal crypto custody agreements by 2026.

To mitigate operational risks associated with single vendors, these financial giants are inclined to adopt a “multi-custodian” model, signaling that custody services are moving toward standardization and commoditization. Meanwhile, the on-chain transformation of capital markets is accelerating. Although current crypto ETFs account for only a small portion of the overall market, Long believes there is huge growth potential, with an estimated 5% to 10% of capital market settlements moving on-chain in the future to pursue higher collateral liquidity and shorter settlement cycles. Additionally, the M&A volume reaching 8.6 billion in 2025 demonstrates that traditional financial institutions are rapidly integrating crypto capabilities through acquisitions.

AI and Blockchain Automation Drive Treasury Transformation

Finally, Monica Long envisions the limitless possibilities brought by cross-industry technological integration, especially the convergence of AI and blockchain, which will enable applications previously thought impossible. Through collaboration between smart contracts and AI, corporate treasuries will be able to automatically execute liquidity management, margin calls, and on-chain repurchase agreements (Repo Agreements), optimizing yields without human intervention.

In this process, privacy technologies will play a crucial role. For example, zero-knowledge proofs will allow AI systems to assess user creditworthiness and risk profiles without revealing sensitive raw data, reducing friction in financial services. Meanwhile, the number of digital asset treasury (DAT) companies has exploded from just 4 in 2020 to over 200 now, with nearly 100 new firms established in 2025 alone.

Ripple itself is actively expanding its footprint, recently forming a strategic alliance with DXC Technology to integrate the $XRP payment system into Hogan, a core banking platform managing over $5 trillion in funds and 300 million accounts, aiming to provide traditional banks with a secure, compliant, and non-disruptive path to digital asset transformation.