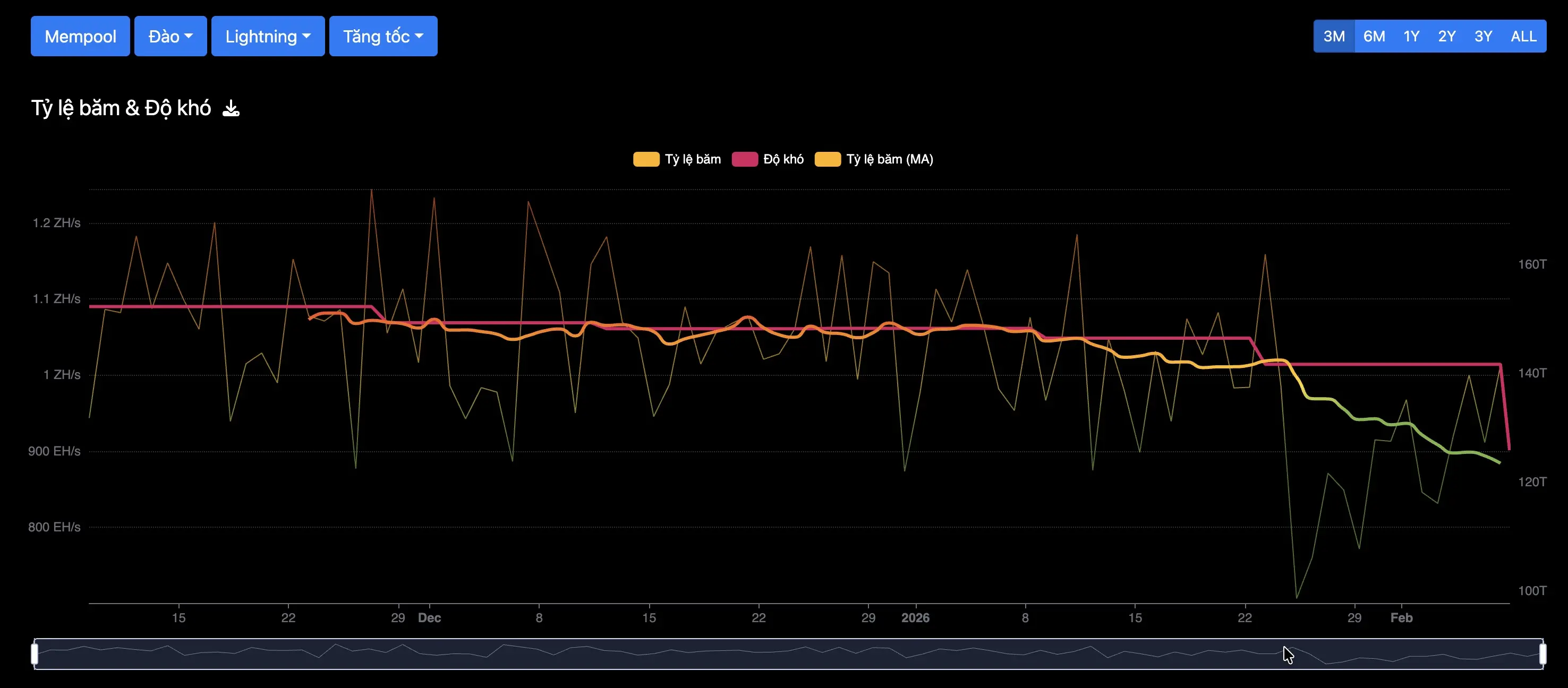

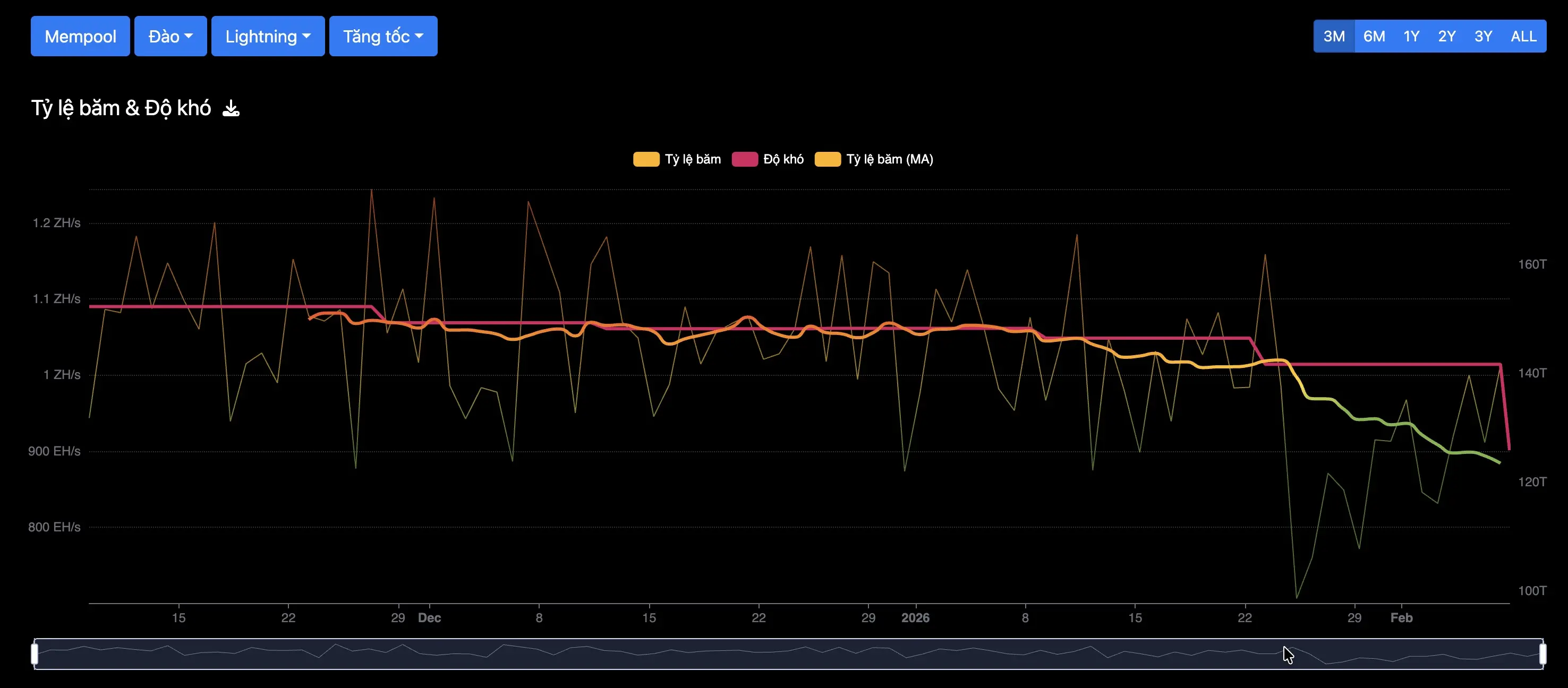

Bitcoin mining difficulty has decreased by 11.16% to 125.86 trillion at block 935,424, marking the largest adjustment since China’s ban on mining in 2021 and ranking among the top 10 largest drops in history.

The main reason is the overall network hashrate dropping by approximately 20% over the past month, as Bitcoin’s price plummeted over 45% from the peak above $126,000 down to the $60,000–$68,000 range, along with the impact of Winter Storm Fern, which forced many miners in the US to temporarily shut down. The storm alone caused about 200 EH/s of capacity to go offline.

Mining revenue continues to face pressure as the hashprice falls to a record low of $33.31/PH/s/day, below the $40 threshold typically considered the break-even point. Currently, only newer machines like the Antminer S23 remain profitable, while many older devices are approaching or already in loss.

The average cost to mine one BTC is around $87,000, significantly higher than the market price of nearly $69,000, indicating that industry profits are tightening. Although the difficulty reduction helps miners stay afloat with higher rewards, the recovery outlook largely depends on Bitcoin price movements in the coming period.

Disclaimer: The information on this page may come from third parties and does not represent the views or opinions of Gate. The content displayed on this page is for reference only and does not constitute any financial, investment, or legal advice. Gate does not guarantee the accuracy or completeness of the information and shall not be liable for any losses arising from the use of this information. Virtual asset investments carry high risks and are subject to significant price volatility. You may lose all of your invested principal. Please fully understand the relevant risks and make prudent decisions based on your own financial situation and risk tolerance. For details, please refer to

Disclaimer.

Related Articles

Phân tích kỹ thuật ngày 21 tháng 2: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Phe bò Bitcoin đã có thời điểm kéo giá vượt mốc $68.300, nhưng lực mua hiện vẫn chưa đủ mạnh để giữ vững vùng giá cao. Nếu không xuất hiện một cú bứt phá đáng kể trong vài ngày tới, BTC nhiều khả năng sẽ khép lại tháng này bằng cây nến đỏ thứ năm liên tiếp. Kịch bản này gợi nhớ đến giai đoạn 2018–20

TapChiBitcoinJust Now

UniCredit: BTC recovery requires market sentiment and ETF inflows to support; falling below $50,000 may face structural changes

Strategists at Intesa Sanpaolo Bank Italy stated that Bitcoin's recent decline reflects weak market sentiment and macro pressures, with a fair value estimated at $75,000. A drop below $50,000 could lead to a deeper shift. Bitcoin's recovery depends on improved sentiment and better liquidity.

GateNewsBot50m ago

Rich Dad Poor Dad author: Has purchased Bitcoin at the $67,000 price level; the US dollar may be impacted by the debt crisis

Robert Kiyosaki, author of "Rich Dad Poor Dad," posted on X that despite the decline in the crypto market, he still bought 1 Bitcoin for $67,000. He believes that when the US dollar system is impacted by debt issues, there will be a large-scale money printing, and with Bitcoin's total supply approaching its cap, its advantages will surpass gold.

GateNewsBot1h ago

ProShares Stablecoin Reserve ETF's first-day trading volume sets a record at $17 billion

ProShares' GENIUS Money Market ETF set a record with $17 billion in trading volume on its first day, far surpassing BlackRock's Bitcoin ETF with $1 billion. The ETF complies with U.S. stablecoin regulations, and analysts believe most of the funds come from Circle.

GateNewsBot1h ago