The Israeli military is hunting for spies on Polymarket

Author: Azuma, Odaily Planet Daily

The unfair competitive advantage brought by insider information has long been a controversial focus on prediction markets like Polymarket.

Previously, during the U.S. military’s arrest of Venezuelan President Maduro, the odds related to the event on Polymarket shifted early (see “When War Precedes News Settlement: How Prediction Markets Price Maduro’s Arrest 6 Days in Advance”). If that suspected insider behavior could be explained by fluctuations in the “Pizza Index,” then this time, the presence of an insider on Polymarket can be said to be fully confirmed.

Israeli Military Internal “Ghost” Hunt

On February 12, The Jerusalem Post reported that a Tel Aviv district court filed charges Monday against an Israeli civilian and an IDF reserve soldier, accusing both of using classified military information to place bets on Polymarket for profit. The court revealed on Thursday that Israeli authorities believe this behavior posed serious operational security risks during wartime.

According to a statement approved by prosecutors, the suspects were arrested during joint operations involving the Shin Bet (Israel Security Agency), the security units under the Ministry of Defense, and the Israeli police. Investigators suspect that some reserve soldiers are leveraging confidential information obtained through their military duties to bet on the timing of military operations for profit.

Following these investigations, the prosecution stated that it has evidence of improper conduct between the civilian and the reserve soldier, and has decided to file charges of “serious security crimes,” bribery, and obstruction of justice. Meanwhile, the prosecution requested the court to extend the suspects’ detention until the case is concluded.

Beyond the information already disclosed, additional details of the case remain legally restricted, including the identities of the defendants, specific betting content, and the flow of related information.

Tracing the Insider

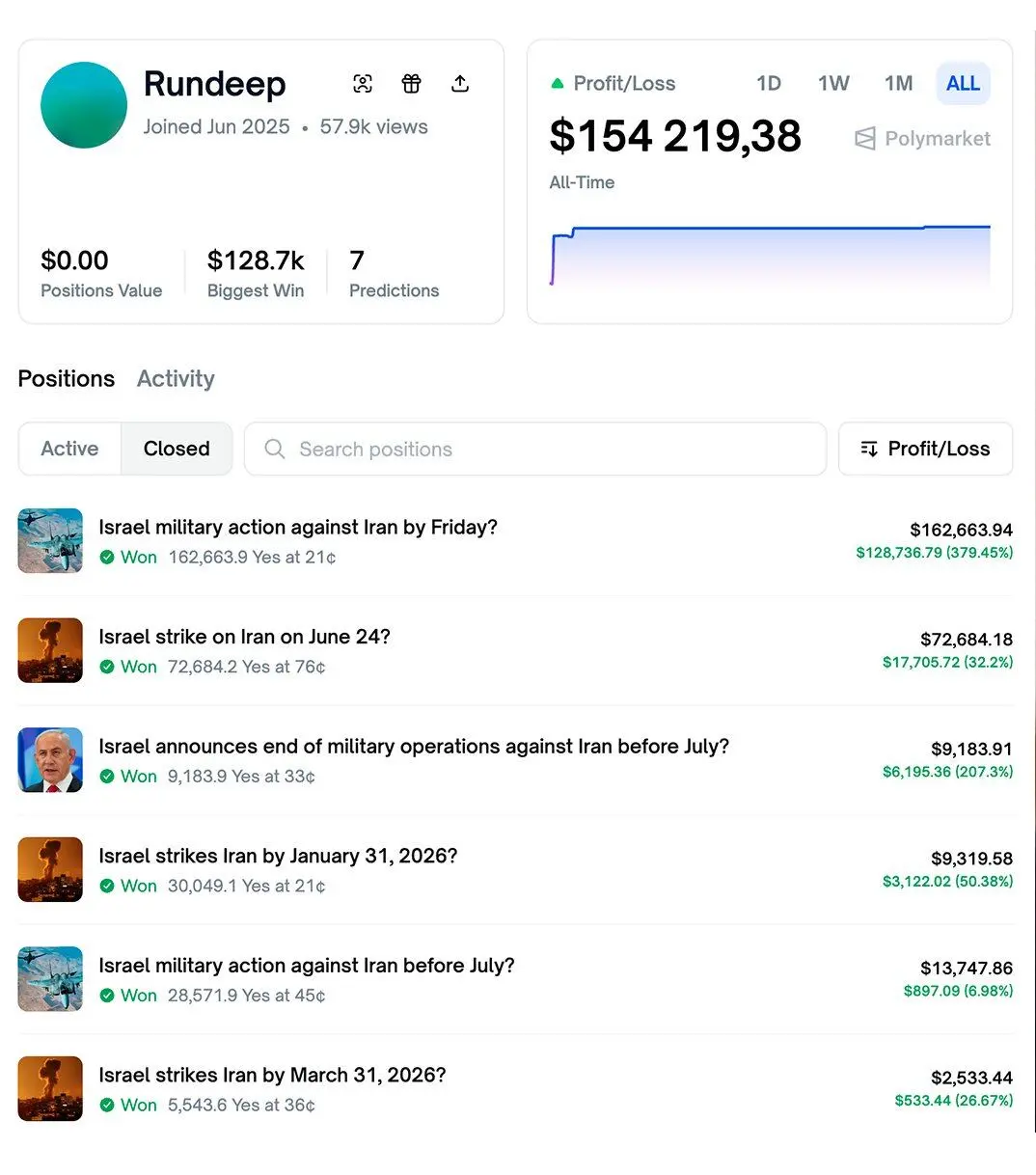

Although we cannot identify the true identity or account details of the insider, the X community had already discovered an account on Polymarket exhibiting obvious abnormal behavior. The Jerusalem Post also published a screenshot of this account’s profits in their report.

As shown above, a user named Rundeep entered Polymarket in June 2025, and subsequently achieved a 100% win rate across six prediction markets related to Israeli military actions, five of which were placed when the probability was below 50%, ultimately earning over $150,000.

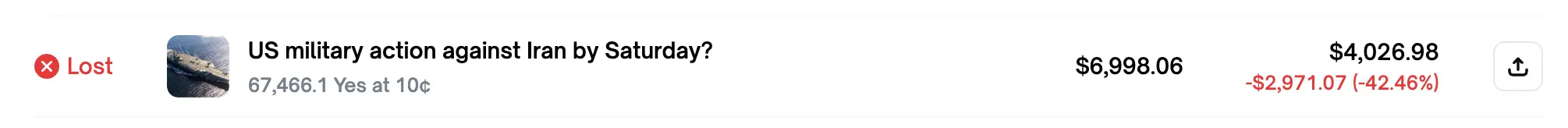

Notably, Odaily Planet Daily found that aside from these “six wins in six battles,” Rundeep had one rare loss on Polymarket. That prediction was unrelated to Israel but concerned whether the U.S. military would take action against Iran before Saturday, June 21, 2025… It seems that allied intelligence is still somewhat unreliable.

The Real Backlash of Prediction Markets—A Deeply Troubling Reflection

Because Polymarket is open and permissionless, anyone can freely place bets on the platform. Objectively, this provides groups with an informational advantage a more convenient channel to monetize their intelligence—driven by profit, those holding unequal information are hard to resist temptation, making insider trading and money-making schemes inevitable.

If such incidents occurred in sports, entertainment, or other conventional fields, the impact might still be manageable. But when these events happen in sensitive areas like politics or war, insider betting incidents could lead to terrifying consequences that are hard to imagine.

Take this article as an example: if an opposing force had used insider betting on Polymarket to pre-guess the direction of Israeli actions, it could have significantly influenced subsequent developments. Many may find it hard to empathize with Israel, but in reality, such incidents could happen to any entity.

In traditional betting, political elections, legislative outcomes, wars, and other public affairs are usually subject to clear restrictions. Whether prediction markets will face similar regulatory constraints in the future remains a long-term regulatory game.

Related Articles

The probability that Bitcoin will decline to $55,000 this year is as high as 73%.

Netherlands imposes heavy penalty on Polymarket! Illegally providing prediction market services, potentially facing a fine of up to 840,000 euros

The Netherlands bans Polymarket, deeming it illegal gambling. Prediction markets are facing setbacks across Europe.

The Clarity Act – a Potential ETH Super-Cycle Trigger As Prediction Markets Signal 90% Approval Odds

The probability that the court orders Trump to refund tariffs on Kalshi quickly rises to 66%