InvestingWithBrandon

No content yet

InvestingWithBrandon

The biggest issue I see a lot of people when they start making more money, or come into money suddenly is.Celebrating too earlyUpgrading their lifestyle too quicklyInstead of using that new income as a tool to keep you earning and growingDon’t celebrate too early, but still find the balance to live life.

- Reward

- like

- Comment

- Repost

- Share

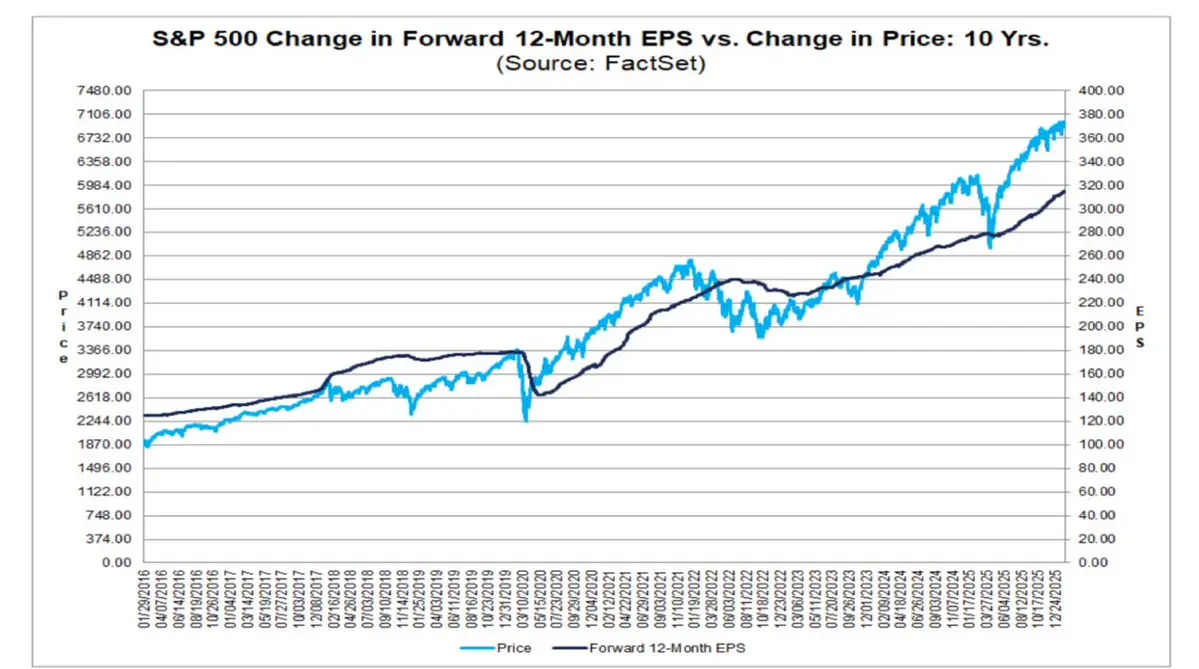

Stocks always revert to the mean. Always.Never forget that.Valuations don’t matter… till they do. As I always say, capitalize on upside, but always be prepared for significant downside, especially when valuations are hot.

- Reward

- like

- Comment

- Repost

- Share

Valuations don\'t matter. UNTIL THEY DO.Retail investors forget this.

- Reward

- like

- Comment

- Repost

- Share

If you own stocks, you prob need to watch this 1 minute clip right now🔴

- Reward

- like

- Comment

- Repost

- Share

If your investments don\'t allow you to sleep peacefully at night, you aren\'t investing, you\'re gambling. Does your strategy pass the sleep test?

- Reward

- like

- Comment

- Repost

- Share

The best investment strategy?Not overcomplicating it. 🥊

- Reward

- like

- Comment

- Repost

- Share

There will be a point in your life where you realize. Going to work at your day job is actually costing you money to be there. You\'ll realize your time is much more valuable than your hourly rate and you can produce MUCH more money investing or simply doing something else.

- Reward

- like

- Comment

- Repost

- Share

Stop selling covered calls on things you are super bullish on!

You are betting against yourself...

CCs cap upside...

You will get burned 1 time with a huge gap up & never do it again.

Owning shares = Bullish

Selling calls = Bearish

You are both at the same time with CCs...

TRAP

You are betting against yourself...

CCs cap upside...

You will get burned 1 time with a huge gap up & never do it again.

Owning shares = Bullish

Selling calls = Bearish

You are both at the same time with CCs...

TRAP

- Reward

- like

- Comment

- Repost

- Share

Selling longer duration puts secured with your base portfolio, NOT CASH, is this biggest investing hack known to man.

CSP sucks.

If you are selling puts, you are bullish...

Why would you wanna sit in that much cash then...

You wouldn't.

Some key things to understand:

Only sell puts on companies that have a moat, pricing power, durable competitive advantage, & are trading near intrinsic value.

Always keep ratios in check of sold put assignment value vs your base portfolio.

Do this and there will never be an issue taking assignment int he rare event you would get assigned.

There will be no bear

CSP sucks.

If you are selling puts, you are bullish...

Why would you wanna sit in that much cash then...

You wouldn't.

Some key things to understand:

Only sell puts on companies that have a moat, pricing power, durable competitive advantage, & are trading near intrinsic value.

Always keep ratios in check of sold put assignment value vs your base portfolio.

Do this and there will never be an issue taking assignment int he rare event you would get assigned.

There will be no bear

- Reward

- like

- Comment

- Repost

- Share

🔴MAJOR problem with retail investors that have a day job.

(Many screw this up)

Most retail investors have a day job. Yes.

So, if you wanna make more money at your day job, what do you do?

- Pick up OT.

- Work harder.

RIGHT!

So they carry that logic to the investing world.

They correlate more work = more money

They correlate more trades = more money.

(couldn't be further from the truth)

This is why 95%+ of ppl underperform the SP500 in the long term... No surprise...

Instead, do this to beat the market in the long term:

- Build base portfolio.

- Sell portfolio secured puts (not cash secured)

(Many screw this up)

Most retail investors have a day job. Yes.

So, if you wanna make more money at your day job, what do you do?

- Pick up OT.

- Work harder.

RIGHT!

So they carry that logic to the investing world.

They correlate more work = more money

They correlate more trades = more money.

(couldn't be further from the truth)

This is why 95%+ of ppl underperform the SP500 in the long term... No surprise...

Instead, do this to beat the market in the long term:

- Build base portfolio.

- Sell portfolio secured puts (not cash secured)

- Reward

- like

- Comment

- Repost

- Share

Your 9-5 will almost never make you rich.

It's designed to keep you comfortable enough to stay, but stressed enough to never leave.

Break the cycle.

Learn to invest with Stocks & Options in a way that leaves you sleeping well every night!

No NOT do crazy day & swing trading.

You work hard for your money, that is gambling most of the time.

It's designed to keep you comfortable enough to stay, but stressed enough to never leave.

Break the cycle.

Learn to invest with Stocks & Options in a way that leaves you sleeping well every night!

No NOT do crazy day & swing trading.

You work hard for your money, that is gambling most of the time.

- Reward

- like

- Comment

- Repost

- Share

Cancelling Netflix for $15/month isn't going to help you.

Making your own coffee to save $5 isn't going to help you.

Income must be INCREASED.

Cash flow must be INCREASED.

Don't cut back on basic life necessities so you can pretend you're doing something good.

Make more money, spend within reason.

Making your own coffee to save $5 isn't going to help you.

Income must be INCREASED.

Cash flow must be INCREASED.

Don't cut back on basic life necessities so you can pretend you're doing something good.

Make more money, spend within reason.

- Reward

- like

- Comment

- Repost

- Share

I make about $30k a month with options.

NO Day trading

NO Swing trading

NO Covered calls

NO Cash secured puts

NO BS

INSTEAD, I DO THIS:

Build base portfolio

Sell portfolio secured puts (not cash secured)

Buy LEAPS with the premium from sold puts

BUY shares with the premium from sold puts

All 1+ year option contracts

I can explain it to a 13 year old & I will likely outperform 95% of people that read this.

Simple wins.

NO Day trading

NO Swing trading

NO Covered calls

NO Cash secured puts

NO BS

INSTEAD, I DO THIS:

Build base portfolio

Sell portfolio secured puts (not cash secured)

Buy LEAPS with the premium from sold puts

BUY shares with the premium from sold puts

All 1+ year option contracts

I can explain it to a 13 year old & I will likely outperform 95% of people that read this.

Simple wins.

- Reward

- 1

- 2

- Repost

- Share

Hashas :

:

Happy New Year! 🤑View More

THE MARKET WILL TEST YOU:

You’ll feel euphoric at the top.

You’ll feel sick at the bottom.

BUT!

If you can sit through both without losing your mind, you’ll be wealthier than 99% of people.

THE EMOTIONAL ASPECT OF INVESTING IS VERY UNDERRATED.

You’ll feel euphoric at the top.

You’ll feel sick at the bottom.

BUT!

If you can sit through both without losing your mind, you’ll be wealthier than 99% of people.

THE EMOTIONAL ASPECT OF INVESTING IS VERY UNDERRATED.

- Reward

- like

- Comment

- Repost

- Share

The day job is a means to an end...

We all started out trading time for money..

BUT

Eventually you'll realize you're losing money working the day job vs investing and building your business.

Opportunity cost!

We all started out trading time for money..

BUT

Eventually you'll realize you're losing money working the day job vs investing and building your business.

Opportunity cost!

- Reward

- like

- Comment

- Repost

- Share

Stock options will CRUSH most people.

Why?

Because what are options actually used for?

- Leverage

- Cash flow

- Hedge

Most retail investors use them mostly for leverage.

Leverage to get "higher returns"

But think about this...

Why on earth would you want a "leveraged return" on a company that you have no clue what direction it will move and when...

Leverage works both ways!

Most use it to lose more...

Instead, only use options to magnify an expected return that you have A LOT of confidence in & you did your homework.

Other than that, stay away.

Yes, selling options for cash flow is great, but

Why?

Because what are options actually used for?

- Leverage

- Cash flow

- Hedge

Most retail investors use them mostly for leverage.

Leverage to get "higher returns"

But think about this...

Why on earth would you want a "leveraged return" on a company that you have no clue what direction it will move and when...

Leverage works both ways!

Most use it to lose more...

Instead, only use options to magnify an expected return that you have A LOT of confidence in & you did your homework.

Other than that, stay away.

Yes, selling options for cash flow is great, but

- Reward

- like

- Comment

- Repost

- Share

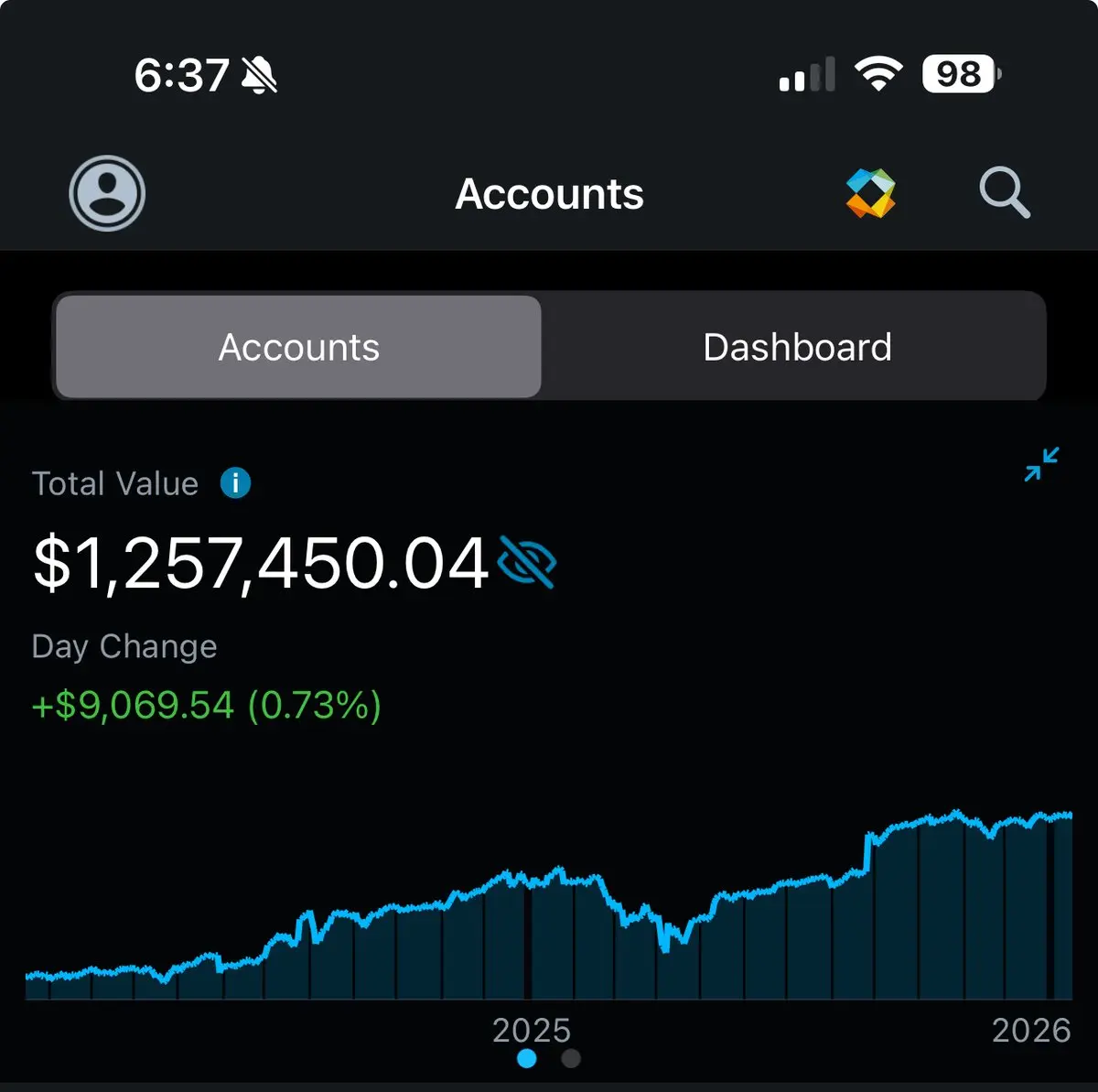

95%+ of retail investors will underperform the SP500 in the long run.

(it's a fact)

Being an expert in this recent bull market does not say much...

I show with 100% transparency how I did in the last 5+ years

Check it out here:

(it's a fact)

Being an expert in this recent bull market does not say much...

I show with 100% transparency how I did in the last 5+ years

Check it out here:

- Reward

- like

- Comment

- Repost

- Share

🟢Align your options plays with the CEO

Align your options plays with the companies goal.

What does the CEO want the company to do?

Boost Revenue

Boost EPS

Boost share price

CEOs are largely paid with stock based compensation.

Stock hits a certain level, they cash out millions if not billions.

BUT!

These options are not short duration.

They are a few years in length.

Because anyone reading this that owns or owned a business knows, you can NOT boost the companies true value in just a few months.

It takes a year or so.

This is why longer duration contracts win & you need to allocate to capture t

Align your options plays with the companies goal.

What does the CEO want the company to do?

Boost Revenue

Boost EPS

Boost share price

CEOs are largely paid with stock based compensation.

Stock hits a certain level, they cash out millions if not billions.

BUT!

These options are not short duration.

They are a few years in length.

Because anyone reading this that owns or owned a business knows, you can NOT boost the companies true value in just a few months.

It takes a year or so.

This is why longer duration contracts win & you need to allocate to capture t

- Reward

- like

- Comment

- Repost

- Share

🟢Warren Buffett became one of the richest people on earth by compounding at an annual growth rate of 19.9%.

What does this tell you?

Why aren't day/swing traders all billionaires?

Why do we see all of their wins?

Why do we not see their losses?

One word.

CONSISTENCY

Warren compounded at 19.9% since 1965.

Anyone can get great returns in bull markets (like right now)

But most will simply not survive the bad times...

That is what makes investors great.

What does this tell you?

Why aren't day/swing traders all billionaires?

Why do we see all of their wins?

Why do we not see their losses?

One word.

CONSISTENCY

Warren compounded at 19.9% since 1965.

Anyone can get great returns in bull markets (like right now)

But most will simply not survive the bad times...

That is what makes investors great.

- Reward

- like

- Comment

- Repost

- Share