Federal Reserve Nominee Changes, AI Bubble Warning! Bitcoin Clears $527 Million in a Single Day

December 16th, Bitcoin retested the $85,000 level, with over $527 million worth of bullish leverage positions liquidated in a single day. This sharp decline was caused by the convergence of two systemic risks: President Trump’s core circle actively pushing for a more independent Federal Reserve Chair candidate, decreasing the likelihood of Kevin Hasset replacing Powell; and hedge fund giant Bridgewater warning that tech companies’ overreliance on debt markets to finance AI investments has entered a dangerous phase.

Federal Reserve Chair Uncertainty Sparks Policy Instability Fears

(Source: Trading View)

Earlier this week, part of the reason for the decline in US stocks was a change in market expectations regarding the next Fed Chair. According to CNBC, President Donald Trump’s core circle is pushing for a candidate perceived as more independent, contrasting with previous market consensus that Kevin Hasset would succeed Jerome Powell. Last Friday, Trump also stated that Kevin Wosch is a very suitable candidate, easing concerns about the dollar’s fragility but also intensifying uncertainty over policy direction.

Why is the change in Fed Chair so critical? Because it directly affects the continuity and predictability of monetary policy. The policy framework during Powell’s term has been well understood and priced in by the market; a new chair could shift policy priorities. Hasset is viewed as a Trump confidant, and markets worry he may lean more toward aligning with the president’s political agenda rather than maintaining independence. Conversely, Wosch, a former Fed governor, emphasizes institutional independence, which could lead to potential disagreements with the White House.

This uncertainty is especially perilous in the current macro environment. The “One Big Beautiful Bill Act” extended tax credits and increased the US debt ceiling by $5 trillion, while the Fed recently decided to expand its balance sheet by $40 billion per month, worsening the situation. The robust yield on 5-year US Treasury bonds signals the market is pricing in higher inflation risks and more complex fiscal-monetary interactions.

After four consecutive weeks of decline, the US dollar index (DXY) found support around 98. This stability indicates increased market confidence in the US government’s ability to avoid a recession, providing some support to stocks but less so for cryptocurrencies. Bitcoin and Ethereum are typically viewed as part of an independent financial system, so a stronger dollar reduces demand for other hedging tools. When the dollar ceases to weaken, the narrative of Bitcoin as “digital gold” for hedging diminishes.

Bridgewater AI Bubble Warning Triggers Risk Asset Sell-off

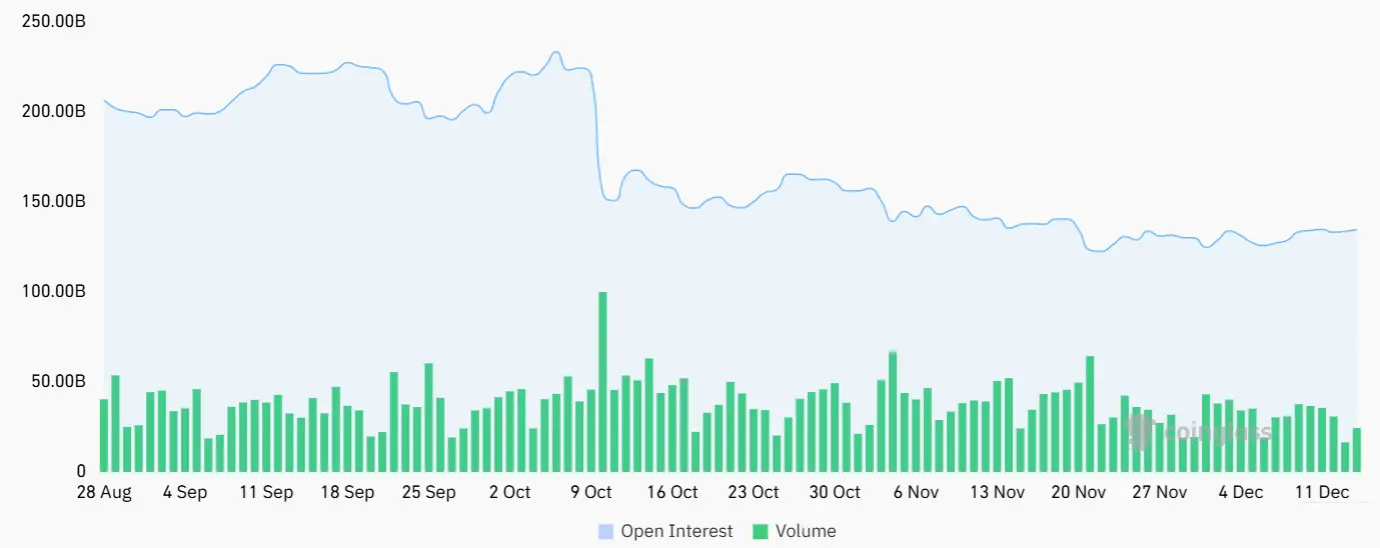

(Source: Coinglass)

Weakness in the AI industry has led traders to increase cash holdings and sell riskier assets such as cryptocurrencies. According to Reuters, hedge fund giant Bridgewater warned that the overreliance of tech companies on debt markets to finance AI investments has entered a dangerous phase. Co-Chief Investment Officer Greg Jensen wrote in a report, “Looking ahead, it’s very likely we will soon find ourselves in a bubble.”

Why is this warning so shocking? Because the AI investment boom has been the core narrative supporting tech stocks and risk assets over the past two years. From OpenAI to Nvidia, the entire industry chain is betting on AI bringing a productivity revolution. However, Bridgewater points out that these investments heavily depend on debt financing rather than actual cash flow and profitability. If interest rate environments change or market sentiment reverses, debt repayment pressures could trigger a chain reaction.

For the cryptocurrency market, concerns over an AI bubble have a dual impact. First, many crypto projects are also riding the AI hype, claiming to combine blockchain with AI technology. If the AI narrative collapses, these projects will be the first to suffer. Second, liquidity in the crypto market is largely derived from cross-sector allocations by tech stock investors. As these investors exit risk assets due to fears of an AI bubble, cryptocurrencies are often the first to be sold.

Data from the consumer sector further amplifies the pessimism. A CNBC survey shows that 41% of Americans plan to cut spending during this year’s holiday season, up from 35% in 2024. Additionally, 61% of respondents report that rising prices with stagnant wages are straining their consumption capacity. US retail sales data for October and non-farm payrolls for November will be released on Tuesday, with markets preparing for potential negative surprises.

Three Deadly Signals of Leverage Collapse

Open interest reaches historical highs: Cryptocurrency futures open interest has reached $135 billion, indicating excessive leverage in the market. High leverage amplifies gains during rallies but triggers cascades of liquidations during declines.

Abnormal negative funding rates: On centralized exchanges (CEX), demand for leverage to short (sell) positions surged, causing annualized funding rates to go below zero. Such abnormal situations where longs earn returns from maintaining leveraged positions usually don’t last long but reflect extreme market pessimism.

Record 24-hour liquidations: Over $527 million worth of bullish leverage positions were liquidated in the past 24 hours, marking one of the largest single-day liquidations recently. Since the crash on October 10th, liquidity has tightened significantly, and some market makers may face huge losses, further deteriorating market depth.

Systemic Risks Compound: Short-term Hope Looks Slim

The overleveraging in the crypto market, combined with broader macroeconomic uncertainties, may continue to exert downward pressure on prices. The unresolved question of the Fed Chair candidate’s future prospects creates policy ambiguity, while warnings of an AI bubble shake the valuation foundation of risk assets. Under this double uncertainty, investors are reassessing risk exposure, and cryptocurrencies—characterized by high volatility and leverage—become prime targets for de-risking.

In the short term, the market will closely watch the US retail sales and employment data released on Tuesday. If the data underperform expectations, it will further confirm concerns about economic slowdown and could trigger another wave of selling. Conversely, strong data may temporarily ease panic but cannot eliminate the two structural risks of the Fed and the AI bubble.

Related Articles

Non-farm payrolls may unexpectedly increase by only 70,000! White House: It's not an employment recession, but a productivity revolution

Kevin Wash's Federal Reserve New Policy! Using AI to tame inflation, refusing to be a big buyer of U.S. bonds

Charlie Munger: How do I respond when assets drop by 50%?

Wosh is about to succeed as Federal Reserve Chair! The probability of a rate cut in June skyrocketed to 46%, boosting risk assets.

Trump to Announce Federal Reserve Chair! Bitcoin-Friendly Kevin Wash's win rate soars to 95%

Gate Daily (January 30): Trump declares a national emergency and Cuban tariffs; The United States will announce a new chairman of the Federal Reserve next week