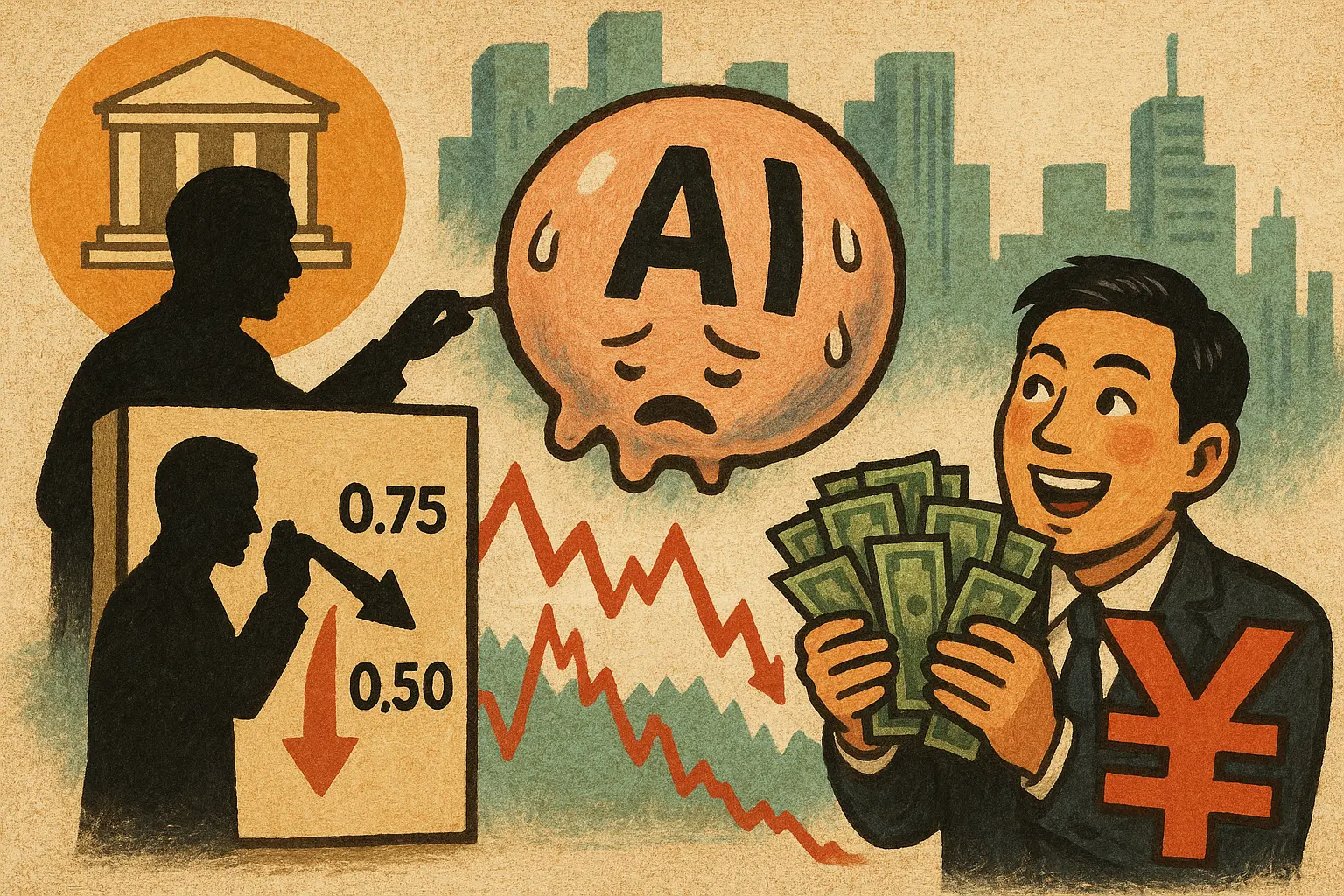

The Federal Reserve (FED) lowering interest rates by 100 basis points is unlikely to save the AI bubble! The renminbi has broken 7 and foreign capital is rushing in.

The Federal Reserve Board of Governors member Waller anticipates that in 2026, interest rates should be lowered by 100 basis points, bringing the rate down from the current 3.5%-3.75% to 2.5%-2.75%, but the US stock market shows no reaction to this. As Bitcoin falls below 85,000 USD, the RMB to USD exchange rate breaks through 7.0315, appreciating over 5.3% compared to April. China's trade surplus reaches a historical high of 1.18 trillion USD, with foreign capital accelerating the purchase of RMB assets for hedging.

Why the Federal Reserve's 100 basis point rate cut cannot save the US stock market

Waller emphasized during an interview with President Trump that U.S. job growth is nearly zero, and interest rates must be lowered at the right pace in a timely manner by 2026 to stabilize the job market. A rate cut of 100 basis points would significantly reduce U.S. Treasury interest expenditures, freeing up more fiscal space to stimulate the economy. However, the market's lukewarm response reveals a harsh truth: monetary policy has become ineffective, and people's focus is no longer on interest rates, but rather on the sustainability of the AI bubble.

The dilemma facing The Federal Reserve Board of Governors is that while lowering interest rates can reduce borrowing costs, it does not address the fundamental problem of cash flow depletion for tech companies. When private equity giants like Blue Owl refuse to fund Oracle's data center expansion, the signal received by the market is extremely clear: investors have lost confidence in the massive spending on AI infrastructure. Companies like Oracle, Meta, and Nvidia have crazily invested billions of dollars in building data centers and procuring GPUs over the past two years, but the revenue realization speed is far below expectations.

The deeper issue lies in the depletion of purchasing power in the U.S. stock market. More and more investors only wish to liquidate their dollar assets or purchase safe-haven assets like gold. The price of gold futures in New York may break through the $4,398 high at any time, and this spread of risk aversion sentiment means that no matter how many basis points the Federal Reserve cuts interest rates, it cannot reverse the trend of capital outflow. When confidence collapses, the transmission mechanism of monetary policy completely fails.

The Chain Reaction Effect of AI Bubble Burst

The Oracle incident is not an isolated case, but the first domino to fall in the AI bubble burst. The Financial Times of the UK reported on December 17 that Blue Owl declined to support Oracle's next $10 billion data center deal, causing panic in the market to spread rapidly. This indicates that U.S. tech companies are facing cash flow pressures and cannot continue to sustain astronomical spending on AI chips and hardware.

The chain reaction is immediately evident. Oracle's stock price plummeted 6% in a single day, while Nvidia, as an AI chip supplier, followed suit with a 4% drop. The Nasdaq index fell by 1.8%, continuing its downward trend. Even more concerning is that the virtual currency market has also been impacted, with Bitcoin's price briefly falling below the important threshold of 85,000 USD. This widespread decline shows that market confidence in dollar assets is collapsing.

The “Trump Account” proposal put forward by U.S. Treasury Secretary Yellen further exposes the panic within the decision-making layer. This proposal requires the federal government to establish a newborn ETF fund, holding U.S. stocks for many years until adulthood before selling, with funding sourced from higher taxes on the wealthy. In plain terms, it forces everyone to take over the U.S. stock market using state power, making every baby born in the U.S. the last buyer of the AI bubble. Financial markets do not buy into this absurd proposal, as it fails to identify the root cause of the U.S. stock market decline—the structural issue that AI investments cannot be monetized.

Three Solid Pillars of RMB Appreciation

Against the backdrop of the crash in the U.S. stock market, the exchange rate of the renminbi against the U.S. dollar has broken through 7.0315, appreciating by about 4000 basis points compared to April of this year, with an appreciation rate of over 5.3%. This strong performance is not based on speculative trading, but rather on three solid foundations.

1. Trade surplus hits historic high

· The trade surplus reached 1.18 trillion USD by November 2025.

· Expected to exceed 1.2 to 1.3 trillion dollars for the year

· Continuous foreign exchange inflows provide exchange rate support

· The most direct proof of the strength of the real economy

2. Foreign capital accelerates allocation of RMB assets

· When the US stock market falls, the A-shares rise for two consecutive days.

· International investment banks generally have a positive outlook on the returns of RMB assets.

· Risk aversion demand drives capital inflow

· Valuation trough attracts long-term capital

3. Collapse of Confidence in Dollar Assets

· The AI bubble burst triggers a sell-off in the US stock market

· Gold prices approach the previous high of 4398 USD

· Bitcoin falls below the 85,000 USD mark

· Global risk aversion drives demand for the renminbi

More and more Wall Street institutions believe that buying and holding RMB assets will yield more returns. This judgment is based on a harsh reality: when the United States bets its entire national fortune on the AI industry while cash flow cannot support it, China showcases the real power of its real economy with a trade surplus of $1.18 trillion. Capital always chases safety and returns, and when dollar assets fail to provide both, the RMB naturally becomes a safe haven.

The great asset allocation migration is happening

Waller's statement on interest rate cuts and the divergence from market reactions reveal a profound shift: monetary policy has become ineffective in the face of asset bubbles. The Federal Reserve can cut interest rates by 100 basis points or even 200 basis points, but it cannot change the fact that AI investments are difficult to monetize. When tech companies are running out of cash and private equity refuses to continue financing, interest rate cuts only delay the collapse rather than prevent it.

The “Trump Account” program from Bessent resembles a desperate struggle. Forcing the entire population to take over with state power essentially acknowledges that the market's spontaneous purchasing power has been exhausted. This kind of program cannot save the US stock market; instead, it will accelerate the collapse of confidence, as it announces to the world: there are no real buyers in the US stock market, and it can only rely on the government to back it up.

In contrast, the appreciation of the Renminbi and the rise of A-shares are built on solid foundations. The $1.18 trillion trade surplus is not based on money printing or policy support but is a direct reflection of the competitiveness of the real economy. When global capital realizes that the AI bubble in the US stock market cannot be sustained, and China proves its manufacturing strength with export orders, a natural migration of asset allocation occurs. The Federal Reserve's interest rate cuts cannot save the collapse of confidence, but Renminbi assets win the favor of capital with real profitability.

Related Articles

Non-farm payrolls may unexpectedly increase by only 70,000! White House: It's not an employment recession, but a productivity revolution

Kevin Wash's Federal Reserve New Policy! Using AI to tame inflation, refusing to be a big buyer of U.S. bonds

Charlie Munger: How do I respond when assets drop by 50%?

Wosh is about to succeed as Federal Reserve Chair! The probability of a rate cut in June skyrocketed to 46%, boosting risk assets.

Trump to Announce Federal Reserve Chair! Bitcoin-Friendly Kevin Wash's win rate soars to 95%

Gate Daily (January 30): Trump declares a national emergency and Cuban tariffs; The United States will announce a new chairman of the Federal Reserve next week