Market bets on 2 Federal Reserve rate cuts by 2026! Trump’s pressure triggers inflation death spiral

The Federal Reserve and the market are experiencing serious divergence in interest rate outlooks for 2026. The market expects 2 to 3 rate cuts (Polymarket shows a 94% chance of a rate cut in June), but the Fed only hints at one rate cut. Trump’s push for rate cuts has been countered by inflation, with economic policy support dropping to 36%. As midterm elections approach, the economy finds itself in an impossible triangle of rate cuts, inflation, and elections.

2026 Fed Rate Cut Forecast Divergence: 2 Times Most Likely

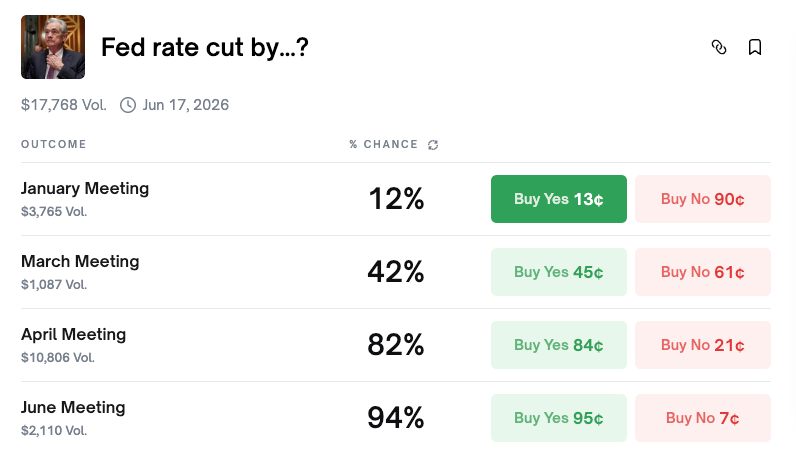

(Source: Polymarket)

According to data from the prediction market platform Polymarket, the probability of a rate cut at the January FOMC meeting is only 12%, with most participants expecting rates to remain unchanged this month. But in the long term, the situation changes significantly: the probability of a rate cut in April rises to 81%, and in June it reaches 94%. Over the year, the highest probability for two rate cuts is 24%, followed by three cuts at 20% and four at 17%. Overall, the chance of two or more rate cuts exceeds 87%.

The CME FedWatch tool depicts a similar picture. The probability of holding rates steady in January is 82.8%, and the chance of at least one rate cut before June is also 82.8%. The probability of 2 to 3 rate cuts before the end of the year is as high as 94.8%. Market consensus is very clear: hold steady in January, start reducing holdings in the first half of the year, and cut 2 to 3 times by December.

However, within the Federal Reserve, a completely different picture emerges. On January 4, Philadelphia Fed President Paulson stated that further rate cuts might have to wait until “later this year.” She emphasized that “small adjustments to the federal funds rate later this year might be appropriate,” but only if inflation slows, the labor market remains steady, and economic growth stays around 2%. She described the current policy stance as “still somewhat hawkish,” implying ongoing efforts to reduce inflationary pressures.

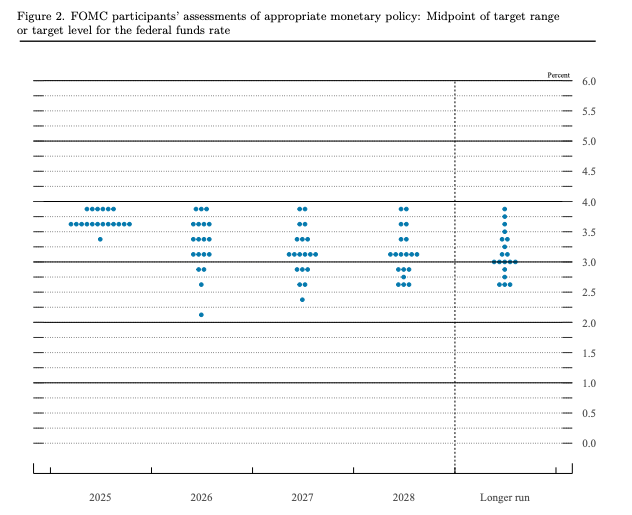

The December FOMC meeting revealed internal divisions within the Fed. The committee lowered rates by 25 basis points to a range of 3.5% to 3.75%, but the voting result was 9 to 3, a larger split than the previous 10 to 2. Powell and Goolsbee favored holding rates steady, while Bowman (widely seen as aligned with the Trump administration) pushed for a 50 basis point cut. A scatter plot reveals clearer signals: seven officials forecast no rate cuts, eight forecast two or more cuts, with the most optimistic predicting rates could fall to 2.125%. The official Fed guidance is for one rate cut, but markets expect two. Why is there a persistent gap between the two?

Inflation Paradox: Trump Pushes for Rate Cuts but Loses Political Capital

(Source: Federal Reserve)

The main reason markets refuse to accept the Fed’s hawkish guidance is President Trump. Since returning to the White House, Trump has been pressuring the Fed to lower interest rates. In the December FOMC vote, an official closely linked to Trump advocated for aggressive easing, exemplifying this dynamic. More importantly, Fed Chair Powell’s term expires in 2026, and the power to nominate his successor lies with the President. Markets widely expect Trump to appoint someone more inclined toward easing monetary policy.

Structural factors also reinforce this view. The Fed has historically cut rates when the labor market is weak, and internal divisions within the FOMC are deepening. Additionally, tariffs may drag down economic growth, increasing pressure for monetary easing. The market’s simple bet: Trump’s pressure combined with potential economic slowdown will ultimately force the Fed to act.

Ironically, Trump needs political capital to effectively pressure the Fed, but inflation is eroding that capital. Recent polls show Trump’s support for economic policies has fallen to 36%. PBS / NPR / Marist surveys indicate 57% of respondents disapprove of his economic management, and CBS / YouGov polls find 50% of Americans say their financial situation has worsened under Trump’s policies.

Rising Living Costs Erode Public Support

Food prices have surged: according to the U.S. Bureau of Labor Statistics, beef prices have soared 48% since July 2020, and the McDonald’s Big Mac meal has increased from $7.29 in July 2019 to over $9.29 in 2024. Egg prices increased approximately 170% from December 2019 to December 2024.

Affordability crisis: In NPR / PBS News / Marist polls, 70% of Americans say the cost of living in their area is “difficult to afford,” a significant increase from 45% in June. “Affordability” has become the most concerning economic issue.

Election validation: In last November’s New York City mayoral election, Democratic state legislator Mamdani won on a platform of reducing the cost of living. Democratic candidates emphasized easing living costs to win gubernatorial races in Virginia and New Jersey. As the midterm elections approach, over 30 Republican House members have announced they will not seek re-election, and political analysts predict a Republican defeat.

Three Scenarios, None Favor Trump’s Wishes

The intersection of monetary policy and electoral politics creates three possible scenarios for 2026, but none allow Trump to achieve his goals. Scenario one: high inflation risks a midterm defeat for Trump, making him a lame-duck president, but high inflation means the Fed has no reason to cut rates, further weakening Trump’s leverage over the central bank. Scenario two: a sharp economic slowdown would lead to more severe political blows for Trump, as voters punish him for economic weakness, but this would give the Fed a reason to cut rates to support growth. Scenario three: a soft landing with slowing inflation could boost Trump’s political standing, but with a strong economy, the Fed would have little reason to cut rates.

In any of these scenarios, Trump cannot simultaneously maximize political power and lower interest rates. These two goals are fundamentally at odds. Upcoming economic data will be decisive in shaping Fed policy and Trump’s political fate.

Related Articles

Non-farm payrolls may unexpectedly increase by only 70,000! White House: It's not an employment recession, but a productivity revolution

Kevin Wash's Federal Reserve New Policy! Using AI to tame inflation, refusing to be a big buyer of U.S. bonds

Charlie Munger: How do I respond when assets drop by 50%?

Wosh is about to succeed as Federal Reserve Chair! The probability of a rate cut in June skyrocketed to 46%, boosting risk assets.

Trump to Announce Federal Reserve Chair! Bitcoin-Friendly Kevin Wash's win rate soars to 95%

Gate Daily (January 30): Trump declares a national emergency and Cuban tariffs; The United States will announce a new chairman of the Federal Reserve next week