Benzet warns Trump: Fed investigation could ruin everything, Powell may refuse to hand over power

Treasury Secretary Yellen told Trump that the Federal Reserve investigation into Powell has “made a mess,” potentially impacting financial markets. Prosecutor Jeanine Pirro initiated the investigation but did not notify the Treasury Department, the White House, or the Department of Justice. Yellen believed Powell would leave when a new chair was appointed, but now his stance is more hardened, making it impossible to hand over power. Smart money holds a net short position of $127 million in Bitcoin, with sentiment indicators showing market bottoming.

Yellen and Trump’s Late-Night Call Revealed

Two insiders disclosed that Treasury Secretary Yellen told Trump on Sunday evening that the federal investigation into Fed Chair Powell has “made a mess,” and could negatively affect financial markets. An informed source familiar with Yellen and Trump’s communication said, “The Secretary is very unhappy; he has already made the President aware of this.” Currently, Trump seems to be deliberately distancing himself from the investigation into Powell.

Sources say that Prosecutor Jeanine Pirro’s Washington office launched the investigation without prior notice to the Treasury Department, White House officials, or the Department of Justice. This bypassing of normal procedures has caused strong dissatisfaction from Yellen, as her role involves managing financial market stability, and a sudden investigation into the Fed Chair could trigger market panic.

Another source indicated that Yellen “believes that Powell would leave when the President appoints a new Fed Chair. But that’s no longer happening. Powell’s stance is now even more firm. This really has made a mess.” This comment reveals the counterproductive effect of the investigation: the plan to pressure Powell politically into resigning early has instead given him moral high ground, making it even less likely he will voluntarily step down.

However, sources say Yellen did not question the necessity of investigating Powell during her conversation with Trump, nor was she defending the Fed Chair. This suggests Yellen’s dissatisfaction mainly targets the manner and timing of the investigation, not the investigation itself. As a former hedge fund manager, Yellen is well aware of the market’s sensitivity to the Fed’s independence; any signs of political interference could cause sharp fluctuations in the dollar, bonds, and stocks.

Legal and Political Dilemmas of Powell Investigation

Federal prosecutors have launched a criminal investigation into Powell, stemming from his testimony before the Senate committee regarding the renovation of the Federal Reserve building. In a Sunday statement, Powell said the investigation is “based on the Fed’s best judgment of public interest in setting interest rates, not on the President’s wishes.” This firm stance indicates Powell views the investigation as an attack on the Fed’s independence, rather than a mere legal process.

President Trump has repeatedly criticized Powell and the Fed, accusing them of refusing his requests to cut interest rates. Such public pressure is extremely rare in U.S. history, as since the 1951 Federal-Reserve-Treasury Agreement, the Fed’s independence has been considered a cornerstone of the U.S. financial system. If the President can threaten the Fed Chair through judicial investigation, it sets a dangerous precedent.

Three Major Issues with Investigation Procedure Violations

Bypassing normal procedures: Prosecutors did not notify the Treasury Department, White House officials, or the Department of Justice in advance

Sensitive timing: Initiating the investigation during market volatility could trigger financial instability

Weak legal basis: Using the building renovation as grounds for criminal investigation, with legal experts questioning its validity

Threat to independence: Politicizing the Fed’s interest rate decisions undermines market confidence in the dollar

This investigation poses short-term political risks to all risk assets, especially U.S. stocks. When markets worry about the Fed’s independence being compromised, investors may reduce allocations to dollar assets and shift to other safe havens. However, a “systemic adjustment” in the stock market could reignite demand for Bitcoin, which, according to analysts at cryptocurrency exchange Bitunix, possesses “non-sovereign” attributes.

Bitcoin’s Non-Sovereign Risk Premium

(Source: Matrixport)

As news of the Fed Chair Powell’s investigation sparks concerns over political pressure and markets, Bitcoin’s narrative as a non-sovereign asset is gaining increasing attention. Against the backdrop of a criminal investigation into Powell, investors are refocusing on Bitcoin, which may bolster its status as a non-sovereign risk asset.

Analysts told Cointelegraph: “When confidence in the dollar’s credibility and central bank independence is questioned, decentralized assets tend to gain a risk premium driven by narrative. In the long term, if political interference in monetary policy becomes a structural issue, Bitcoin’s role as a ‘non-sovereign risk asset’ could be further reinforced.”

In the past 24 hours, Bitcoin has risen 0.85%, while privacy-focused tokens Monero (XMR) surged 18%, and Zcash increased 6.5%. Renowned Bitcoin analyst Will Clemente said, “Bitcoin was made for environments like this.” On Monday, Clemente posted on X: “The President is going after the Fed Chair. As governments diversify reserves, metal prices soar. Stocks and risk assets hit all-time highs. Geopolitical risks are rising.”

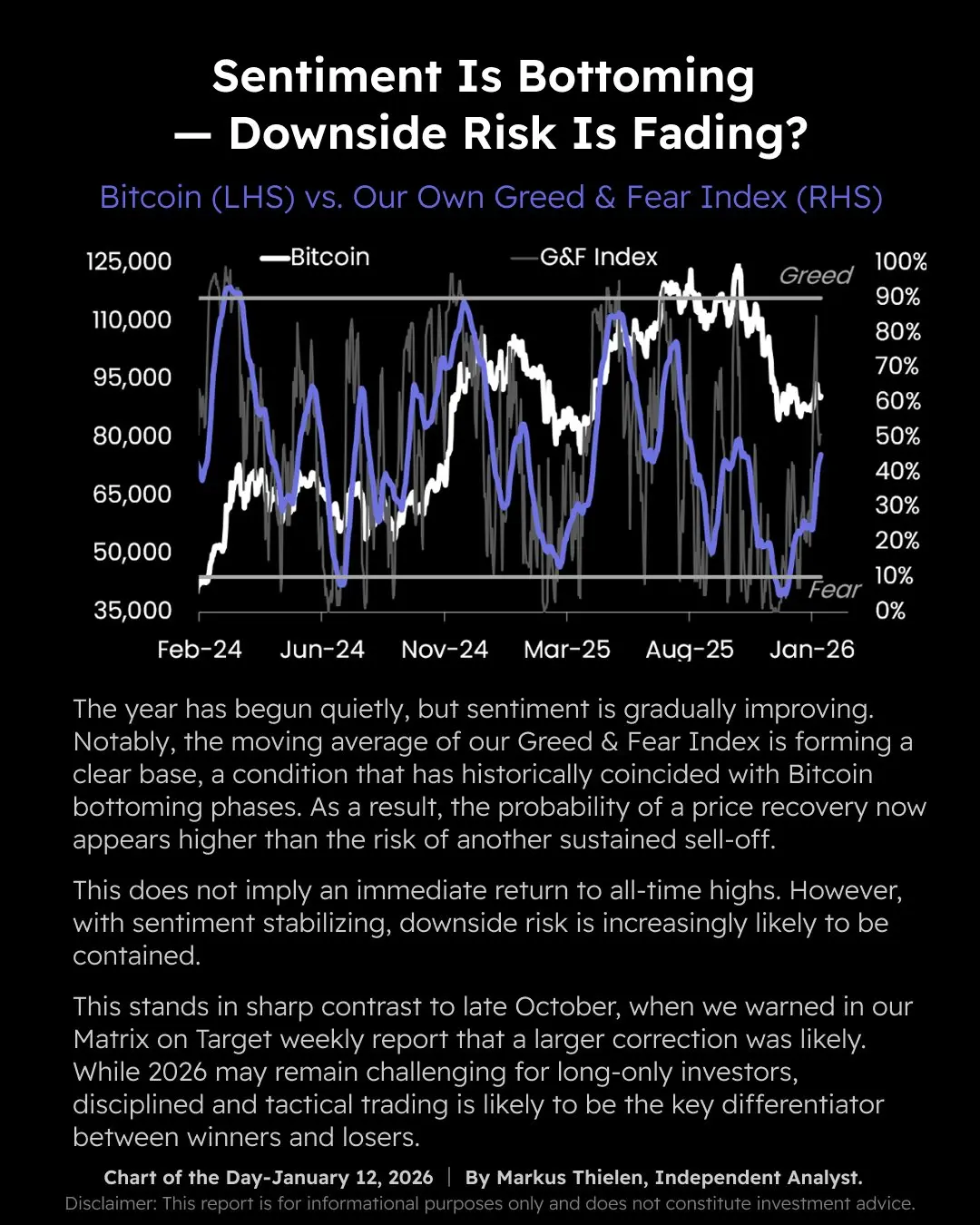

However, data from crypto platform Matrixport shows that investor sentiment is gradually improving, increasing the likelihood of a crypto market rebound. In a Monday X post, Matrixport wrote: “Our greed and fear index moving averages are forming a clear bottom, which historically aligns with Bitcoin’s bottom phases.”

(Source: Nansen)

Despite improved market sentiment, the industry’s most successful traders (referred to by Nansen as “smart money”) are still betting on a short-term decline in Bitcoin. Data from crypto intelligence platform Nansen shows that savvy traders hold a total of $127 million in net short positions in Bitcoin, with $1.6 million of new short positions added in the past 24 hours. Nevertheless, smart investors still hold a net long position of $674 million in Ethereum and are net long $72 million in XRP, indicating higher expectations for upward potential in these tokens.

Related Articles

Non-farm payrolls may unexpectedly increase by only 70,000! White House: It's not an employment recession, but a productivity revolution

Kevin Wash's Federal Reserve New Policy! Using AI to tame inflation, refusing to be a big buyer of U.S. bonds

Charlie Munger: How do I respond when assets drop by 50%?

Wosh is about to succeed as Federal Reserve Chair! The probability of a rate cut in June skyrocketed to 46%, boosting risk assets.

Trump to Announce Federal Reserve Chair! Bitcoin-Friendly Kevin Wash's win rate soars to 95%

Gate Daily (January 30): Trump declares a national emergency and Cuban tariffs; The United States will announce a new chairman of the Federal Reserve next week