The era of the Federal Reserve gradually printing money is here! Lyn Alden: Mildly stimulating assets without explosive growth

Economist and Bitcoin advocate Lyn Alden states that the Federal Reserve is entering a phase of gradual money printing, gently stimulating asset prices without engaging in large-scale liquidity injections. She recommends holding scarce assets and rebalancing from overly optimistic sectors to underexposed ones. Trump has nominated hawkish candidate Waller, with the March rate cut expectation dropping to 19.9%. Alden states that all policies ultimately lead to currency depreciation.

The Fundamental Difference Between Gradual Money Printing and Large-Scale Liquidity Injections

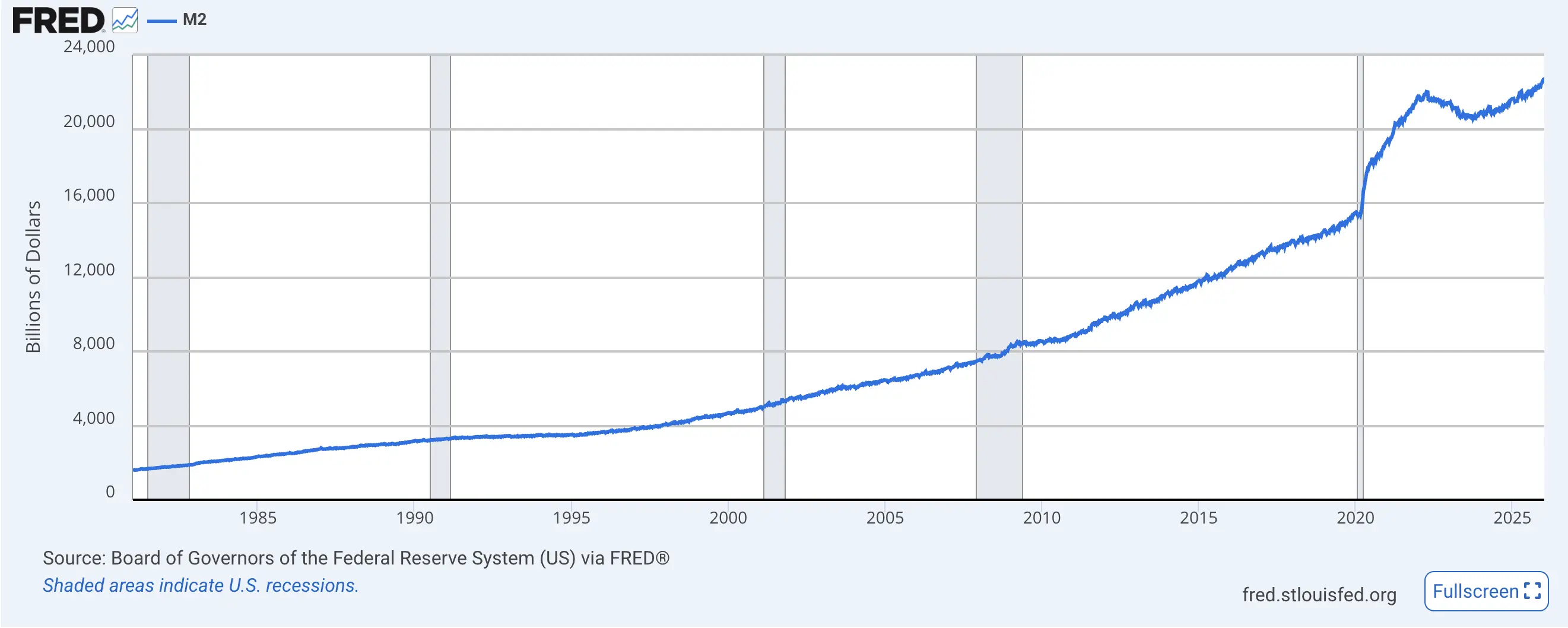

(Source: FRED)

The U.S. Federal Reserve is entering a “gradual” money printing era, which will “moderately” boost asset prices, but not as dramatically as many in the Bitcoin community expect from “large-scale money printing.” According to economist and Bitcoin advocate Lyn Alden, “My basic expectation aligns roughly with the Fed’s: that the growth rate of the balance sheet will be roughly the same as the growth rate of bank total assets or nominal GDP,” she said in a February 8 investment strategy briefing, adding, “Overall, this means I still prefer to hold high-quality scarce assets and tend to rebalance investments from overly optimistic sectors toward underexposed ones.”

The distinction between “gradual money printing” and “large-scale liquidity injections” is crucial. Large-scale liquidity injections refer to the Fed significantly expanding its balance sheet over a short period, such as during the COVID-19 pandemic when trillions of dollars were printed within months. This operation rapidly reduces the dollar’s purchasing power and drives asset prices soaring; Bitcoin’s rise from $10,000 to $69,000 during that period benefited from this.

Gradual money printing, on the other hand, expands the money supply at a pace aligned with natural economic growth. If nominal GDP grows by 4% annually, the Fed’s balance sheet also grows by 4%. This type of expansion merely maintains the existing monetary system rather than providing additional stimulus. Its impact on asset prices is minimal because the increase in money supply is absorbed by economic growth, avoiding significant liquidity spillover effects.

Alden believes whether the Fed is implementing quantitative easing is purely a semantic issue, as all policies ultimately lead to currency depreciation. This philosophical view reveals the essence of fiat systems: whether tight or loose, the long-term trend is an increase in money supply and a decline in purchasing power. The only difference is the speed of depreciation, not whether it occurs.

Three Key Features of Gradual Money Printing

Speed matches economic growth: Balance sheet expansion rate aligns with nominal GDP growth

No additional liquidity: New money is absorbed by economic growth, with no spillover effects

Mild asset appreciation: Supportive effect is much lower than the large-scale QE of 2020

For the Bitcoin community, this signals a need to adjust expectations. Many Bitcoin holders hope the Fed will restart large-scale QE, pushing Bitcoin prices higher again. However, Alden’s analysis indicates this scenario is unlikely in the short term. The Fed is more likely to adopt a moderate expansion policy, which offers limited support for Bitcoin. Investors should lower expectations for a “money-printing bull market” and focus instead on Bitcoin’s fundamentals—such as institutional adoption, ETF inflows, and expanding use cases.

Looking at the M2 money supply chart, the Fed’s M2 continues to grow. This growth is not explosive but steady and gentle. This visualizes Alden’s concept of “gradual money printing.” Compared to the steep rise of M2 during 2020-2021, the current growth curve is much more subdued.

Waller’s Hawkish Nomination Heightens Policy Uncertainty

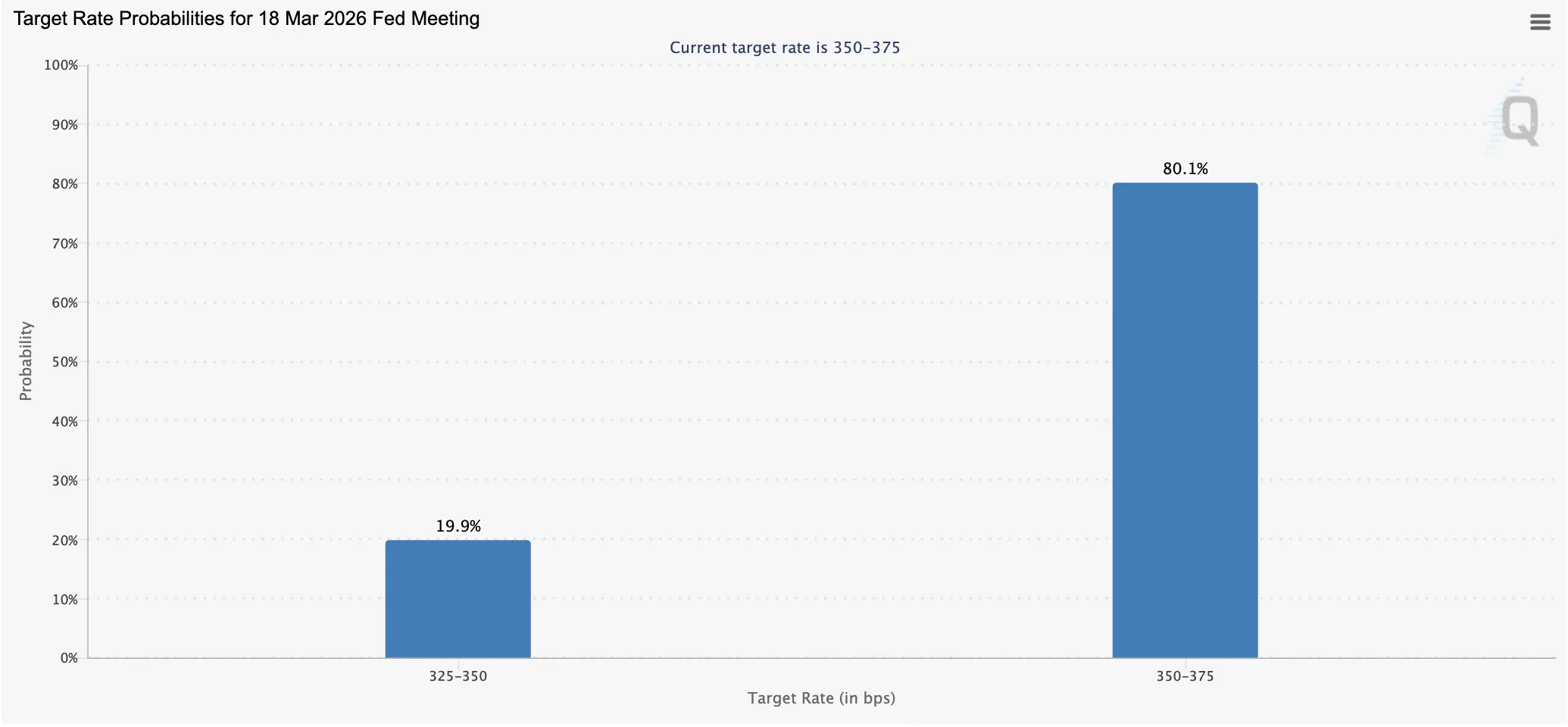

(Source: CME FedWatch)

Previously, U.S. President Trump nominated Kevin Waller as the next Federal Reserve Chair, which caused a stir among market traders. They believe Waller is more hawkish on interest rates compared to other Fed candidates. Interest rate policies influence cryptocurrency prices. Generally, increasing the money supply to expand credit is seen as positive for assets, while raising interest rates to tighten monetary policy usually leads to economic slowdown and price declines.

About 19.9% of traders expect a rate cut at the upcoming March Federal Open Market Committee (FOMC) meeting, down from 23% in last Saturday’s CME FedWatch data. This decline in expectations directly reflects the hawkish effect of Waller’s nomination. The market perceives that if Waller takes office, the likelihood of a rate cut will decrease significantly, and the Fed may maintain high interest rates for a longer period.

Powell’s term as Fed Chair expires in May 2025, but Waller has yet to be confirmed by the U.S. Senate. This increases uncertainty about the interest rate policy trajectory in 2026. This power transition period itself is a market risk factor. If Waller’s confirmation is delayed or faces resistance, the Fed could be in a leadership vacuum for months.

After the December FOMC meeting, Powell stated: “In the short term, inflation risks are skewed to the upside, while employment risks are skewed to the downside. The situation is severe. There is no risk-free path for policy.” Such ambiguous statements are common during Powell’s tenure, making it difficult for markets to form clear expectations. If Waller takes office, his hawkish stance at least provides a clearer policy direction, which, although unfavorable for risk assets, adds a measure of certainty.

Shift from Optimistic to Underexposed in Scarce Asset Allocation

Alden’s investment advice is highly practical: hold high-quality scarce assets and rebalance from overly optimistic sectors to underexposed ones. This strategy is especially relevant in the current environment. Scarce assets include Bitcoin, gold, quality stocks, and real estate—assets with limited supply and stable demand. Under the gradual money printing model, these assets will appreciate moderately, not skyrocket, but outperform inflation.

“Rebalancing from overly optimistic sectors” is a key recommendation. Which sectors are overly optimistic now? AI stocks surged significantly in 2025 and are overvalued; certain meme coins and altcoins are being pumped without fundamentals, which Alden suggests should be reduced. Conversely, underexposed sectors may include traditional value stocks, some undervalued commodities, and high-quality crypto assets during bear markets.

For Bitcoin, Alden’s framework offers a clear positioning: it is a scarce asset worth holding, but don’t expect it to skyrocket solely due to Fed policies. Bitcoin’s appreciation depends on improving fundamentals—accelerated institutional adoption, continuous ETF inflows, expanding use cases. If these factors materialize, Bitcoin could outperform other assets even in a gradual money printing environment. But relying solely on liquidity-driven growth is likely to disappoint.

From a macro perspective, Alden advocates a balanced rather than extreme approach. She does not advocate for outright bearishness nor full optimism but emphasizes selective allocation and dynamic rebalancing. This pragmatic attitude may be the best strategy in today’s highly uncertain environment. Blind optimism or pessimism could lead to missed opportunities or unnecessary losses; adjusting positions based on valuations and expectations allows maintaining competitiveness across different market conditions.

Regarding the long-term impact of Fed policies, Alden’s “semantic issue” argument is worth pondering. Whether it’s QE, QT, or neutral policies in name, the inherent logic of fiat systems ensures long-term expansion of the money supply. This structural trend of currency depreciation is precisely the long-term value proposition of hard assets like Bitcoin. While short-term policy shifts may not cause explosive rallies, in the long run, Bitcoin as a hedge against fiat depreciation will see increasing demand.

Related Articles

Rich Dad Poor Dad author: Has purchased Bitcoin at the $67,000 price level; the US dollar may be impacted by the debt crisis

Breaking News》The Supreme Court rules that Trump's $175 billion tariffs are illegal! The White House announces contingency plans, Bitcoin hits $68,000

U.S. February S&P Global Services and Manufacturing PMI preliminary figures both below expectations

U.S. December inflation higher than expected, U.S. stocks open lower

Global Market Collapse Next Week? Fed Liquidity Moves Raise Red Flags Across Stocks And Crypto

Federal Reserve Paper Highlights Kalshi as Emerging Macro Forecast Tool